The Cost of Containing Inflation

July 15, 2022

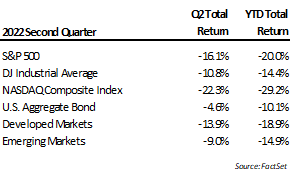

There is no way to sugarcoat it, the second quarter was a historically negative one for virtually all financial assets. When combined with results from the first quarter, many financial markets had annual first-half results that marked either the worst in history or if not, the worst in many decades. The breadth of the selloff left few assets unscathed, hitting fixed-income and most international markets as well. Historically, bonds often rally in times of stock weakness, though with rates so low and the markets expecting hawkish policy action, this offset did not happen. Through the second quarter, financial markets were unnerved by the magnitude of the shift in monetary policy guidance and the severity of inflation forces evident across economic news. Though the Fed is only partially through what stands as its current guidance, the relentless talk of further tightening has itself had a significant impact on markets and economic activity. Whether they can stick to that plan will depend on the degree to which economic growth and inflation have already been impacted.

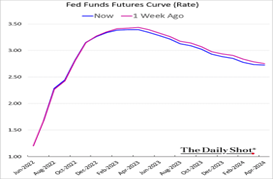

With the Consumer Price Index (CPI) tracking over 8% for several months now, the Fed has had to toe the line on its revised plan to aggressively tighten monetary policy to slow the economy. So far, they have hiked rates at the three most recent meetings to bring the current Fed Funds rate to a target of 1.5%-1.75%. Looking ahead, the stated plan is to keep hiking aggressively, with the next meeting or two slated for increases of 0.75% a piece. The market consensus sees short-term rates of about 3.25%-3.5% in mid-2023 (see the following chart). The recently reported June jobs report, which was stronger than expected, probably makes a 0.75% increase at the upcoming July meeting a high probability, though successive hikes may hinge more on the economy not slowing too dramatically. The Fed so far has looked past the weakness in equity markets but may need to alter plans if the slowdown in housing and other parts of the economy spreads.

As it stands now, the shape of the Fed Funds curve implies rates will be increased to a point where a recession or other challenges emerge which will then follow policy accommodation yet again. The market’s current view is the Fed Funds rate makes it almost up to 3.5%, or the equivalent of 12-13 quarter-point increments. That view and the belief the economy could weather an increase of that magnitude is very aggressive, in our opinion. The idea of a soft landing is now fading like the transitory inflation label. The pace of rate increases in a highly leveraged economy is quite fast and indications of stress are already becoming evident in several parts of the economy. Predictions of a recession not happening until mid-2023 or later are too complacent and, in our opinion, by some measures may already be here.

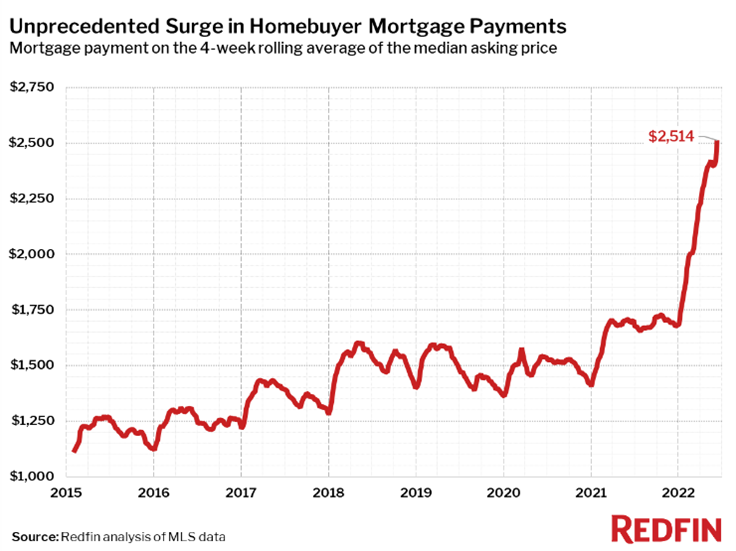

Real estate prices are very sensitive to interest rate changes because most transactions use borrowed money. The cost of paying for a home has risen dramatically over the past year, hit by both the increase in interest rates and the rapid rise in property values post-COVID. The following chart from Redfin shows the impact of the combined factors on a typical monthly payment – almost 50% higher in the past year. This takes its toll on prospective buyers and consequently, many indicators are pointing to a rapid slowdown in the housing market. The number of homes being put on the market has jumped along with the ratio of listed homes seeing price cuts. And of those sold, a growing percentage are not making it to close. According to Redfin, in June almost 15% of the homes that went under contract were ultimately canceled. The swift change has already been reflected in real estate related employment with appraisers, mortgage brokers, and title workers among those that have experienced layoffs.

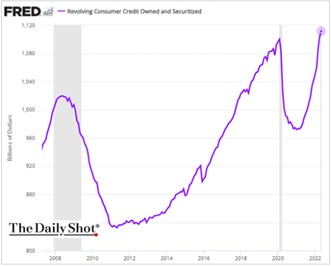

The squeeze is not limited to big-ticket items. Retail sales have contracted over the past three months, as consumers are forced to allocate a larger share of income to food and energy. Further, we believe the “quality” of the retail sales figures is also deteriorating. Consumer credit, which measures installment loan growth and other financings have seen large increases this year, a reversal from the early post-COVID trends. COVID stimulus and changes in people’s work and commuting habits provided a lot of extra cash for consumers which reduced the need for credit financing. Now, credit usage is rising and points to consumers using more borrowed money to fund necessities (chart below shows aggregate consumer credit). For insight into the underlying mix of that spending, June data from Mastercard showed fuel purchases up 42% and grocery up 14% versus last year, growth rates that soundly exceed income gains.

Not surprisingly, the pressure of inflation coupled with the stress of global conflict is taking a large toll on consumer optimism. Some measures of consumer confidence are now below the lows recorded during the Great Financial Crisis (GFC) in 2008. In many respects, financial conditions were worse during that period, but geopolitical risks and political polarization could be described as much higher now and contributing to the plunging consumer confidence figures. Either way, such low readings of consumer confidence are often coincident with recessionary times. Low consumer confidence readings usually are reflecting economic challenges and can in turn be self-reinforcing. Often, periods of economic stress will see consumers defer or reduce purchases, adding to the headwinds on growth.

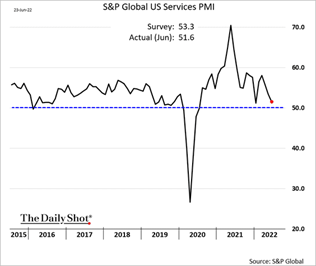

Consumers aren’t the only ones with concerns about the future. Surveys of both manufacturing and service businesses are also recording sharp declines. The chart below is the June PMI survey data for service businesses and though it remains above 50, a level that usually will separate growth from contraction, the trajectory approaching that line has been steep. In some areas where demand was voracious and getting product was a struggle in the post-COVID period, the dynamic has snapped back with unanticipated consequences. Walmart and Target were examples when they each surprised the market during the past quarter saying they went from inventory shortages to excess inventory in several discretionary categories. Reports of inventory surpluses are also showing up in the computer and smartphone supply chain after being badly stressed for over two years. However, a lot of the swing is due to falling demand. Most of what we are seeing coming back into ready supply are discretionary items while the things people need – food and energy, among them – remain supply constrained.

Some of this is by design. The Fed’s primary tool to try and reduce inflation is to raise rates – slow the demand side of the supply/demand equation – without being so aggressive as to create a nasty recession. Looking back at the consensus outlook on Fed moves says we are about halfway through the process, though financial markets price in those future expectations to some degree. Unfortunately, the rate increase tool is not precise, and it can be hard to know in advance what is too far. We noted a few risk factors suggesting a recession is already here or very close and there are others, as well. Further, even if hiking rates lowers inflation via a slowdown in the economy, it might have little impact on remaining supply chain problems.

The Fed, however, continues to say they see a strong, or at least, solid economic environment. Employment, one of the more important factors the Fed watches, continues to hold up quite well measured by new job creation and the unemployment rate. Unfortunately, this is usually a lagging indicator of turns in economic conditions and could cause the Fed to underestimate weakening conditions. In our opinion, there is a risk the Fed will feel obligated to stay aggressive with rate hikes to the point something backfires. Today’s financial markets use a lot of leverage and past cycles of rising rates have produced many examples where things subsequently broke (housing crisis, Asian currency crisis, high yield) as a result of sharp moves in policy rates.

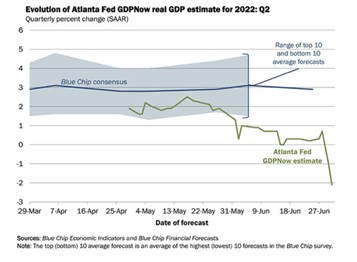

Interestingly, some of the Fed’s own tools also may be saying we are already in a recession. The Atlanta Fed has a model referred to GDPNow that incorporates data points as they are released to project the GDP for the current quarter. That model had been steadily lowering its outlook for the second quarter and recently fell to -2.1%. Real GDP in the first quarter was -1.6% meaning that if the GDPNow model is correct, we will have the traditional definition of a recession with two consecutive quarters of negative GDP. Official determinations of a recession can be more nuanced, but the point is there is a lot of data suggesting activity has slowed sharply.

The upside is that slowing demand should start to show up in at least some reduction of price pressures. The market looks ahead for changes like this and as the data softened in early June, the inflation beneficiary sectors like energy and commodities sold off rather aggressively (they were about the only area of big YTD gains), and fixed income rates dropped back a bit. We think this could be a sign the big CPI numbers that have roiled markets over the past three months could start to soften some as well. We are not implying the inflation pressures will recede to pre-COVID levels, but as we move into the second half of the year CPI numbers will stop coming in much higher than forecast. That would likely be better for risk assets and give Fed added flexibility in managing its plan. Long-term, we think inflation will remain a bigger issue for investors than it was in the past decade. Energy and other key resources may stay at elevated levels due to the lack of supply growth over the past decade (underinvestment) and ongoing trade ramifications stemming from the war in Ukraine.

Earnings season starts in late July and will offer a better read on how companies are managing the inflation environment and the new world order. First quarter results in April didn’t reflect a full quarter of the war and its related fallout or the brunt of the spike in energy prices. Many companies reported rather solid results in light of the challenges, but many offered less or even no guidance as to what results might look like in the second quarter. Early on, many large companies have seemed to have been effective in passing on higher costs, though as those conditions persist it can become more difficult to maintain margins (look back to the consumer confidence and credit data).

The compression in stock prices means that at least some of this risk is priced in, but is it enough? We view several of the headwinds as quite meaningful to operations, particularly for companies with a global presence. Europe is unquestionably in a difficult spot due to its reliance on Russian energy and lack of ready alternatives. Reports from Germany of energy rationing and moves to re-fire legacy sources such as coal point to the range of problems people face there. As energy and food inflation problems in other parts of the world become more pressing, capital has flowed into U.S. Dollar and out of foreign currencies. That relative appreciation makes U.S. goods more expensive for foreign buyers and diminishes the value of foreign earnings, resulting in lower earnings for U.S. companies. Raising interest rates here also will tend to increase the value of the dollar, adding to the pressure on many foreign countries.

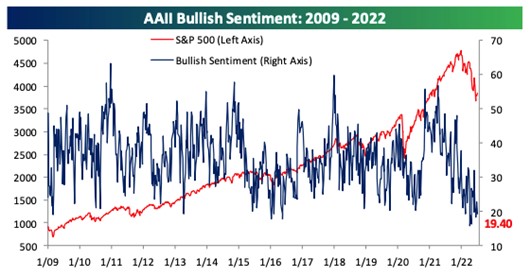

With stocks down a lot already this year, many of the challenges discussed are not lost on markets. Investor sentiment, like consumer confidence, is downbeat and has been working to price in scenarios like a recession. The chart below from Bespoke Research shows bullish sentiment bouncing for some time on the lower bound of its range from the past 13 years. Extreme sentiment in itself is not a catalyst to reverse price trends but can provide fuel to a catalyst that alters investment views. As earnings season unfolds and managements discuss business trends, we will be looking for signs such as whether bad news is treated as more bad news for their stock or can their shares start to show some resiliency to current conditions.

However, even if earnings season provides some respite from the barrage of bad news that has pervaded the first half of the year, we believe investors may benefit from maintaining a conservative stance. While elevated cash balances don’t compensate for the current inflation rate, many traditional recession risk strategies have done far worse. On a historical basis, fixed income has had an even worse start to the year than stocks. The traditional 60/40 stock/bond portfolio that in past economic cycles has been very effective in offsetting volatility extremes lost more than 16% through June. To avoid credit risk and pick up yield we made some direct purchases of Treasuries during the second quarter. Our purchases were generally set to yield about 3% over the next two to three years to maturity, better than bank or money market rates, but giving up some real return for the safety of Treasuries. Even with these actions, cash balances are running above typical targets and we expect they will do so until there is a firmer view of the magnitude of any recession.

The global economy has piled on a lot of debt over the past decade. It is one of the reasons we think it will be very difficult for the U.S. and probably most of the global economy to avoid a recession. However, unlike the Great Financial Crisis of 2008, the significant growth in leverage isn’t in households, it is from all the new debt issued by governments the world over. As noted, policy shocks can have big reverberations and the stakes are very high when the parties at risk are countries. Just last week, Sri Lanka succumbed to rising food and energy import costs while carrying a high debt load. Lacking the benefit of a reserve currency and having already diluted their currency, the value of their currency fell rapidly making the cost of importing food and energy spiral higher. Ultimately, the government declared the country bankrupt and citizens overran public institutions in protest. The rapid appreciation of the U.S. Dollar this year likely contributed to the speed of the collapse.

The implications of policy decisions and geopolitical developments are extraordinarily high right now. Inflation and other related issues have put large swathes of people on edge around the world. The bankruptcy of Sri Lanka may be the most extreme example of late, but many other countries face growing angst about their citizen’s ability to meet basic needs. Policy and actions have the potential to quickly tip things either way. Looking ahead, we think this difficult phase will be with us a while longer, though we also remember markets have faced similar or worse uncertainties and found a way through. In the past, many productive decisions to resolve the crisis have eventually emerged. We believe there are easier paths to resolution than others, though we are waiting for signs the productive path will be chosen. As these developments unfold, we will continue to communicate any changes in our view and corresponding implications for client allocations. We thank you for your continued trust in us and hope you and your family remain in good health.

Bradley Williams, Chief Investment Officer

Lowe Wealth Advisors

Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by Lowe Wealth Advisors, LLC), or any non-investment related content, referred to directly or indirectly in this newsletter will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this newsletter serves as the receipt of, or as a substitute for, personalized investment advice from Lowe Wealth Advisors, LLC. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his/her situation, he/she is encouraged to consult with the professional advisor of his/her choosing. Lowe Wealth Advisors, LLC is neither a law firm nor a certified public accounting firm and no portion of the newsletter content should be construed as legal or accounting advice. A copy of the Lowe Wealth Advisors, LLC’s current written disclosure statement discussing our advisory services and fees is available upon request. If you are a Lowe Wealth Advisors, LLC client, please remember to contact Lowe Wealth Advisors, LLC, in writing, if there are any changes in your personal/financial situation or investment objectives to review/evaluating/revising our previous recommendations and/or services.