April 16, 2021

Summary:

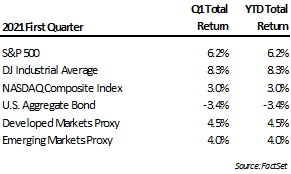

- Solid quarter for stocks overall, although there was a change in sector leadership with Technology lagging Energy and other sectors.

- Bonds saw on of their worst quarters historically.

- Interest rates began to rise along with equity markets reflecting the growing optimism of economic recovery, consumers being “unleashed” to spend and anticipated impact of the recent stimulus packages.

- Inflation becoming a concern as conditions are more ripe to precipitate an increase in inflation unlike the markets have seen in more than a decade.

- With Interest rates low, the impact of the rising U.S. debt balance has been muted. If rates turn higher, the impact of the $28 trillion in U.S. debt will be more significant.

- LWA has made strategic adjustments in many actively managed allocations based on this backdrop and will continue to monitor the overall situation.

- Infrastructure and Tax Packages, if passed could have broad impact on market performance and strategic financial planning.

The first quarter of 2021 saw solid gains for stocks driven by optimism around COVID trend improvements and prospects for economic reopening. Bonds, on the other hand, delivered one of the worst quarterly returns in history as the economic enthusiasm drove rates up from near-zero levels. This theme also translated into very different sector performance than the market has been used to as the almost forgotten energy sector rose about 30% in the quarter while the stalwart tech sector lagged with a gain of “only” 2%. In the bond market, there was much more action than may have been apparent. The rate on the 10-year U.S. Treasury rose 0.8% during the quarter, which is not huge on an absolute basis, but when measured against a base rate of less than 1%, the impact on bond values was substantial. Generally, our client allocations have avoided long-maturity bonds precisely for this risk, though by example, TLT, a popular ETF that tracks the U.S. 20-year Treasury, had a total return loss of 14% in the quarter.

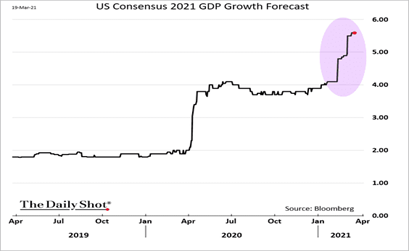

The rise in stock prices and interest rates reflects rapidly growing optimism in the strength of economic recovery expected to unfold as more are vaccinated, virus numbers ebb, and businesses reopen. Evident in the chart below is how economists have been almost unable to keep up with the process of factoring in various growth drivers. Right now, the current estimate for U.S. economic expansion in 2021 is somewhere north of 6%, a level not experienced in decades. Of course, to be fair, most of this is rebound growth off the COVID contraction and it will take some time to see where employment and growth can settle out, but it is not likely to stay in the six percent range. Meanwhile, enjoy it while we have it.

In the next couple of months, a combination of activity restarts and comparisons to depressed data last year is likely to result in many eye-popping growth statistics. The recently released jobs data for March showed over 900 thousand jobs created versus the consensus forecast of 660 thousand. The unemployment rate was 6%, down from its peak last year of over 14%. The strong headline numbers were boosted by reopenings that brought back a surge of restaurant, travel, and leisure employees. The total employment base remains below the pre-COVID levels, but the gap is expected to narrow further over the next several months. Completely closing that gap and then surpassing previous employment levels will probably stretch out over a much longer period as the economy adjusts to more permanent structural changes brought on by COVID. Also, data indicates the pace of rehiring still faces challenges in attracting people that have effectively had higher income by not working as a product of supplemental unemployment benefits and repeated stimulus distributions.

A range of other economic data is also showing the swell in demand brought on by increased business and social mobility. Higher savings reserves, recent stimulus payments, the motivation to get out in the springtime weather all are working to create a rush in activity. Regional surveys of business activity, travel, and occupancy statistics, as well as data on orders, inventory, and shipping, all point to a strong pickup. Collectively, data from the Institute for Supply Management (ISM) provides a broad read on current business conditions and outlook. The most recent reading of 65 came in well above the 50 level that is considered the dividing line between expansion and contraction. Rarely do large economies experience such a whipsaw from one extreme to another, but then again COIVD has proven record-setting on many levels.

The concentrated increase in economic activity concurrent with the ongoing stimulus is bringing with it higher prices for many goods and services. Inflation has been a passing concern only intermittently over the past decade, but sustainable increases were rarely reflected in the data. This time around, the threat of trending inflation looks more likely with price increases larger, more widespread, and the result of several factors. The dramatic growth in the money supply from the various COVID relief efforts has resulted in the basic inflation definition of more money chasing fewer goods. Additionally, disruptions creating supply constraints have made conditions worse. Events including the recent blockage of the Suez Canal, the Texas freeze, and a fire at a key Japanese semiconductor plan have all had far-reaching impacts on supply chains. The semiconductor disruption, in particular, seemed minor at the time but the fallout has been extensive as shortages of key chip components have halted the production of goods ranging from computers to autos.

Collectively, it would be hard for conditions to be riper to precipitate an increase in inflation unlike the markets have seen in more than a decade. The surge in demand, supply constraints, and the fast-growing base of cheap or free money all pressing at the same time has produced sharp price increases in the widest array of commodities and material inputs we can recall seeing in a very long time. So far, policymakers have not been overly concerned about the inflation risk, though we think consumers are just beginning to feel the real effects. The magnitude and breadth of price increases already in place virtually ensure a flow-through to a wide range of finished goods and consumables. Crops, energy, building materials, and computer chips are among the items experiencing large price increases and, in some cases shortages of supply, meaning there are few things where consumers will be able to avoid the consequences.

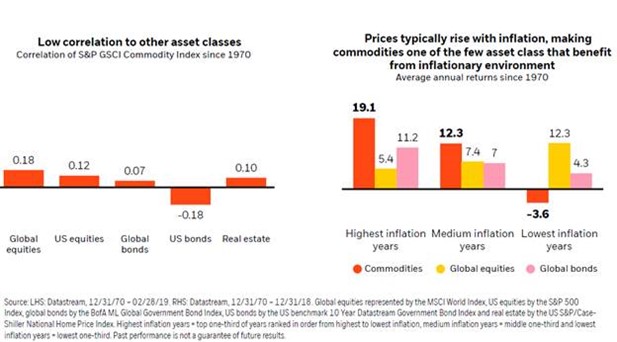

A less-than-temporary change in the inflation backdrop has important considerations for the investment landscape. Strategies that have focused on thematic investing and high growth (regardless of valuation) that have performed so well over the last several years could fall from favor while more traditional value stocks, commodities, and other physical assets may be better placed to protect against erosion of purchasing power. This change is a result of higher implied interest rates that reduce the present value of far-off expectations. Conversely, bonds and other fixed payment streams can see values suffer during times of rising inflation and, potentially as well, rising rates. The charts below from BlackRock provide some historical data on how different types of investments perform under different inflation scenarios.

In the fourth quarter of last year and the first quarter of this year, we added positions based on these factors across many of our strategies. These investments vary but include more traditional value companies and holdings in the energy sector and commodities. At the same time, we have guided our fixed income exposure lower by not reinvesting maturities and trimming holdings in many situations. Most of our fixed-income holdings have very short maturity horizons so a rise in rates has had a less negative impact on the current values, but we are sensitive to potential loss of purchasing power associated with these low-yielding instruments.

Inflation can be a very punitive, regressive form of tax which is why signs of increases deserve a lot of attention. Fighting back against inflation typically requires policymakers to raise interest rates to cool off the economy and the excess demand. The popular euphemism is taking away the punch bowl. However, right now policymakers the world over are trying to combat the impacts of COVID and have shown little appetite to be the spoiler by preemptively hiking rates. At the most recent Federal Open Market Committee policy meeting last month, Jerome Powell was quite adamant the Fed won’t raise rates here until they see a 3.5% unemployment rate and inflation averaging 2%. He stressed it would be preferred to see the economy “running hot” and inflation above 2% for a period before acting. Keeping rates too low in an environment such as this runs the risk of further fanning the inflation forces.

However, there are a couple of key impediments for policymakers to factor into any decision to increase market interest rate targets. First, any increase would run counter to current initiatives centered on stimulating the recovery and, second, raising rates may increasingly become a budgetary issue. Even though the current statistics are depicting a healthy bounce in jobs and economic activity, this is happening simultaneously with ongoing external infusions of cash. The latest round of stimulus payments of $1,400 for individuals and thousands more for many families hit just this past month while supplemental unemployment benefits have been renewed and remain in effect until September of this year. Hiking interest rates under these conditions seem highly contradictory and this factor alone may make it more difficult for the Fed to consider acting earlier than currently outlined.

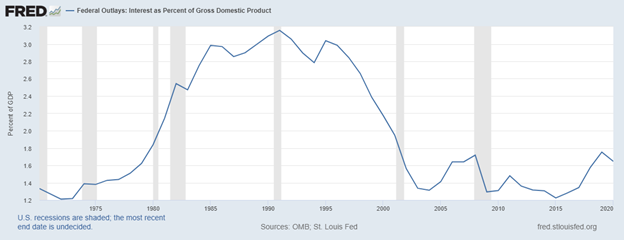

Even as growth and/or inflation develop in a way that may justify an increase in interest rates, we believe an additional consideration could center on the corresponding incremental fiscal interest expense. Interest payments on the rising debt balance of the U.S. have not harmed the budget while rates have been steadily worked lower, however, as debt balances have ballooned higher in response to COVID, increasing rates on a significantly higher debt balance can become meaningful. The graph below shows interest expense as a percent of GDP, now under 2% and far less than the prior peak of almost 3.2% in the ‘90s, but already rising. If interest rates start trending higher rather than lower, the impact will be magnified and could be a hurdle for a rate increase decision. For reference, in the early ‘90s, total public debt was less than 60% of GDP, while now that figure is roughly 130% and rising (source: St. Louis Fed). With the total outstanding U.S. debt over $28 trillion, every 1% rise in the average interest rate paid will increase the interest expense as a percent of GDP by 1.4%.

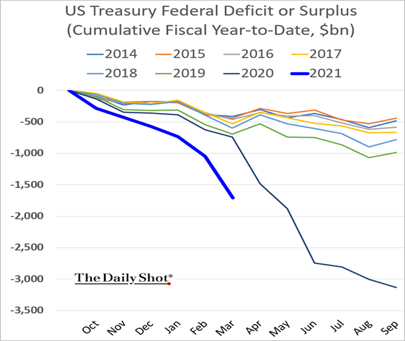

The U.S. fiscal indebtedness is growing at a faster clip due to the actions taken to address the economic disruption of COVID and now through new policy measures intended to continue the recovery. Financial markets have not appeared overly concerned about the rise in fiscal debt around the world, though it typically is the type of issue of when it matters, it really matters. The forecast sees sizeable deficits for the foreseeable future. The chart below graphs the trend in deficit by year and shows that the first half of this fiscal year has witnessed the largest year-to-date funding gap in recent history. While we don’t think it has been the primary source of the rise in interest rates over the past several months, we do believe it is a contributing factor. As the funding gap increases, it necessitates finding more buyers for the bond issuance. Attracting more buyers with rates so low is a challenge, and thus the pressure on rates.

The Fed has been covering a significant portion of this gap for years now by printing money and purchasing bonds. At the most recent Fed meeting, Chairman Powell confirmed that they plan to continue to buy $80 billion worth of government bonds and $40 billion in mortgage bonds monthly – or $1.4 trillion per year. Looking at that graph again, one can see the Federal deficit is already $1 trillion larger than last year’s record level while Congress continues to look to pass additional, multi-trillion stimulus bills yet to be included in these figures. The numbers are big, and the current trend has only seen them become larger. According to our analysis, the plan for future commitments will need either higher market rates (with potential growth and market value consequences) or more Fed purchases to cover the obligations. The legislative proposals have looked at recouping some of the spending in taxes, but we think it will be a fraction of the additional spending. The trade-off in the legislative process is the more that is attempted to be recaptured through taxes, the greater the headwind on economic activity.

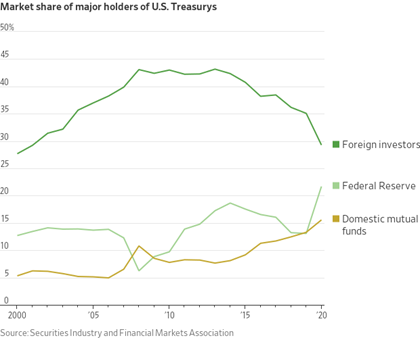

The unbridled willingness to spend stems from an economic theory spreading in Washington referred to as MMT (Modern Monetary Theory). The MMT believers contend deficits don’t matter and creating new money should be the primary focus to achieve full employment. Only when full employment is achieved would inflation be a risk, and this could be balanced through higher taxes. The theory is supported by the idea the U.S. has a long history of running deficits and expanding its debt without major issues. However, in the past, the U.S. has enjoyed very strong international demand for its debt as the leading global superpower and de facto world reserve currency. If that source of demand for our debt diminishes, it needs to be offset from either of two alternatives – domestic buyers of Treasury debt or the Fed. The following chart shows foreign investors have been reducing their relative holdings of U.S Treasury debt for several years now. In our view, the trend of growing deficits and more stimulus significantly increases the likelihood more intervention will be needed from the Fed. We believe these factors can feed back into the current inflation cycle in a more significant fashion than in the past.

Although we believe the case for rising inflation is more pressing now, the outcomes remain dependent on how future events unfold. Running monetary policy hot and generous legislative measures are actions that would bolster the inflation risks. Economic growth would presumably be higher with more money in the system, but it is likely to undermine the purchasing power of today’s dollars. Infrastructure spending, perpetual social programs (e.g., Universal Basic Income), and debt or other obligation forgiveness (student loans, rent) are proposals that could further increase government spending relative to receipts and lead down this path. Alternatively, if further measures fail to pass and monetary policy becomes more restrictive, the natural headwinds created by elevated commodity prices and higher rates would most likely slow the economy and again shift the discussion back to deflationary scenarios.

We would like to provide a forecast with high confidence on how the economy may continue to grow and its relationship to financial markets but with undetermined variables measuring in the trillions, any certainty is impossible. In stark contrast to this time last year, sentiment on the equity market is now extremely optimistic as people see the large improvements in various data. Making capital allocations in these environments requires careful consideration of associated risks. In our opinion, the recovery has significantly expanded the list of investment landscape sectors that could be described as a bubble. Assets that become the focus of a speculative bubble often go far higher than a prudent investor may expect, but most often the corrective side of the price chart is quite steep. In these conditions, we remind investors that sometimes means holding lower-yielding assets or cash to preserve value is the best long-term strategy. We believe markets will remain subject to several external factors yet to come this year. As these developments unfold, we will continue to communicate any changes in our view and corresponding implications for client allocations. We thank you for your continued trust in us and hope for good health.

Bradley Williams, Chief Investment Officer

Lowe Wealth Advisors

Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by Lowe Wealth Advisors, LLC), or any non-investment related content, referred to directly or indirectly in this newsletter will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this newsletter serves as the receipt of, or as a substitute for, personalized investment advice from Lowe Wealth Advisors, LLC. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his/her situation, he/she is encouraged to consult with the professional advisor of his/her choosing. Lowe Wealth Advisors, LLC is neither a law firm nor a certified public accounting firm and no portion of the newsletter content should be construed as legal or accounting advice. A copy of the Lowe Wealth Advisors, LLC’s current written disclosure statement discussing our advisory services and fees is available upon request. If you are a Lowe Wealth Advisors, LLC client, please remember to contact Lowe Wealth Advisors, LLC, in writing, if there are any changes in your personal/financial situation or investment objectives to review/evaluating/revising our previous recommendations and/or services.