New Year Brings Old Problems

January has not been kind to America over the past several years. In 2019, the nation entered the year amidst what would turn out to be the longest federal government shutdown in American history. In 2020, the country found itself in the middle of presidential impeachment proceedings and staring down the barrel of a novel pneumonia-causing virus emerging from Wuhan, China. In 2021, the nation found itself strangled by that very same virus, and then experienced gut-wrenching violence in Washington, D.C.

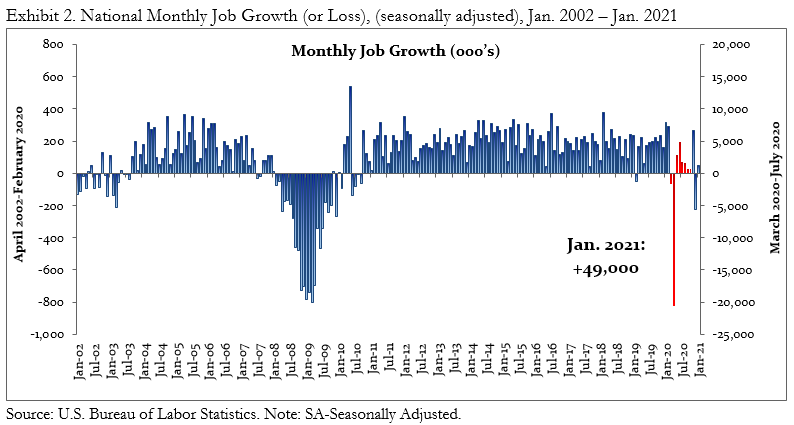

Meanwhile, economic data have recently taken a turn for the worse. After adding 12.5 million jobs during the seven months following March and April’s employment bloodbath, employment growth faltered. According to the data released by the Bureau of Labor Statistics, the nation lost 227,000 jobs on net in December 2020. A combination of waning stimulus impacts and the reintroduction of social distancing mandates caused America’s brief recovery to end. In January, the nation added a lackluster 49,000 net new jobs, statistically indifferent from zero.

Were it not for 81,000 temporary positions added, January would have represented a second consecutive month of job loss in America. There is a kernel of positivity in that statistic, however. The fact that employers added a meaningful number of temporary jobs suggests that many are experiencing growing demand for goods and services, but are not yet confident enough to add full-time staff. This may be a portent of better things to come. That said, for now, the U.S. economy is operating at stall speed, and one could make the case that a second recession has begun.

The nation’s rate of unemployment fell to 6.3 percent in January. While this is much-improved from April 2020’s monstrous 14.7 percent rate, it is also misleading. Since February, about 4.3 million Americans have left the U.S. labor force. Were those people included in unemployment calculations, the official rate of unemployment would be in the range of 9 percent.

Economy Slows After Rapid Recovery in 3rd Quarter

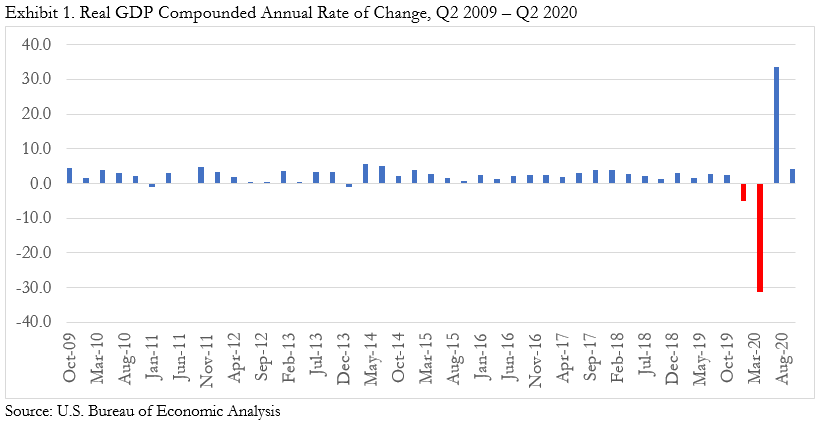

After experiencing the largest economic contraction in modern history during the 2nd quarter of 2020 (-31%), the economy rebounded during the third, expanding 33 percent. Despite additional growth during 2020’s final quarter, the economy shrank 3.5 percent last year.

Here are some of the major phenomena observed in 2020:

- Interest rates declined as liquidity increased, inducing more people to pour money into assets like U.S. equities and bitcoin. Consequently, many asset prices surged even as the broader economy struggled.

- The U.S. housing market is booming as more people/families seek to take advantage of low mortgage rates, more aggressively social distance, demand more space for home offices and gyms, and form households.

- E-commerce and online activity are booming, with companies/applications like Instacart, DoorDash, Zoom, DocuSign, Amazon, and many others catalyzed by the pandemic and stay-at-home mandates.

- Commercial real estate is in crisis, with remote work, truncated business travel, and online sales diminishing demand for commercial space, perhaps for years to come.

- The number of long-term unemployed Americans has been surging. By January 2021, the number of people jobless for 27 weeks or longer surpassed 4 million. The extent to which these people will rejoin the labor market is unclear.

- Inflation is picking up as subdued supply capacity meets rising demand. This is likely to become even more apparent later this year.

- Socioeconomic disparities ramped higher during the crisis as many entry-level and near-entry-level workers lost jobs while asset prices raced higher. This will impact both fiscal and monetary policymaking for years to come.

Looking Ahead

Vaccinations are here. While COVID-19 heavily shaped the economic outcomes of 2020, vaccinations are likely to overwhelmingly influence 2021’s outcomes. The notion among most economists is that the back half of 2021 will be simply spectacular for economic growth.

There are some sources of risk. First, there is the possibility that not enough Americans will be vaccinated to recreate a sense of normalcy. Moreover, the pace of vaccine distribution has been below expectations thus far. Second, if interest rates rise in the latter part of the year, America’s heavily leveraged economy may not produce the expected level of growth. Rising interest rates may also induce reversals in equity and other markets, compromising both investor and consumer confidence in the process. Third, between now and the year’s second half, many additional businesses will falter. If enough healthy economic tissue is destroyed, the economy will not have the requisite number of firms ready to rapidly gear up for economic growth come the summer.

Despite those caveats, the baseline expectation remains that the U.S. economy will experience rapid economic recovery during the latter half of 2021. The recuperative powers of the U.S. economy were on full display during the summer of 2020 as the economy reopened. The expectation is that we will see a repeat performance later this year.

Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by Lowe Wealth Advisors, LLC (“Lowe”), or any non-investment related content, made reference to directly or indirectly in this newsletter will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this newsletter serves as the receipt of, or as a substitute for, personalized investment advice from Lowe. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his/her individual situation, he/she is encouraged to consult with the professional advisor of his/her choosing. Lowe is neither a law firm, nor a certified public accounting firm, and no portion of the newsletter content should be construed as legal or accounting advice. A copy of Lowe’s current written disclosure Brochure discussing our advisory services and fees is available upon request. Please Note: If you are a Lowe client, please remember to contact Lowe, in writing, if there are any changes in your personal/financial situation or investment objectives for the purpose of reviewing/evaluating/revising our previous recommendations and/or services, or if you would like to impose, add, or to modify any reasonable restrictions to our investment advisory services. Lowe shall continue to rely on the accuracy of information that you have provided.