Pivot or No?

January 17, 2023

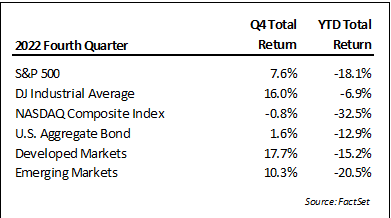

Most stock indices finished the year above the lows of 2022, though the recovery was truncated in December and the typical end-of-year seasonal rally was rather muted. Tech and consumer discretionary stocks remained under pressure through the end of the year. Foreign markets experienced a more substantial recovery in the fourth quarter as the most feared scenarios stemming from the energy crisis were averted. Still, most foreign markets ended the year with double-digit declines. Fixed income also saw a bit of recovery in the fourth quarter, but nothing to materially offset the large declines for the year. Markets continue to face restrictive policy inclinations aimed at curtailing inflation while at the same time digesting more signals of a slowing economy. 2022 was the year policy radically shifted to address surging inflation; 2023 will have investors watching how policy balances the inflation flight against the economic slowdown brought on by higher rates.

Both the pace and magnitude of rate increases weighed heavily on markets in 2022 and made for a year of extremes. For context, the S&P500 had its worst year since 2008 and recorded the fourth worst performance since 1957, when the index moved to a composition of 500 stocks. The bond market, which often can help mitigate losses in years where stocks fall, saw a record decline of its own, recording the worst annual performance, ever. (Measures of the bond market are more varied, but several sources refer to 2022 as the largest annual decline for the bonds.) Tech, theme, and other speculative stocks experienced significant declines. The NASDAQ was down more than 33% last year and previous favorites like Tesla, Amazon, and META were each down 50% or more. Energy was the lone industry sector in the green, up almost 60%. Among the next best assets were Utilities and gold – roughly flat. 2022 was a year that offered few hiding places from market declines and many possibilities for substantial loss. These results left the benchmark 60/40 (stock/bond) portfolio down more than 16% on the year, it’s worst showing ever.

In 2022 the Fed moved its short-term policy rate target from 0% – 0.25% to 4.25% – 4.5% and sold securities from its balance sheet in an effort to suppress inflation. This change in interest rates quickly caused a cooling effect in leverage-sensitive sectors such as housing and auto sales but other parts like business services and employment held up firmly throughout the year. Consumer inflation (CPI) stayed stubbornly high, with most months coming in higher than economist forecasts. This kept the Fed, which focuses principally on consumer inflation and employment, to remain on the defensive, frequently reiterating plans for further policy tightening. As a result, the market dynamic, particularly in the second half of the year, centered on how far can policy constriction go before it results in a severe recession, or a hard landing?

Entering 2023, signs of an economic slowdown appear to be spreading. Business services, a sector that had held up well through most of 2022, saw a sharp decline in its final December reading, seeing the survey measure point to contraction for the first time in the year. Counterintuitively, stocks rallied on the news from the hope it may prompt the Fed to slow or cease its tightening actions, but markets also need to factor in what this data says the current economic trajectory. Commentaries from industry organizations (shipping) and businesses point to conditions that are still softening. Amazon has annual revenue of roughly half a trillion dollars and as a result, has a broad insight into economic activity and trends. In the December quarter Amazon management cautioned repeatedly about economic softening and made significant workforce reductions in what is seasonally its busiest time of year.

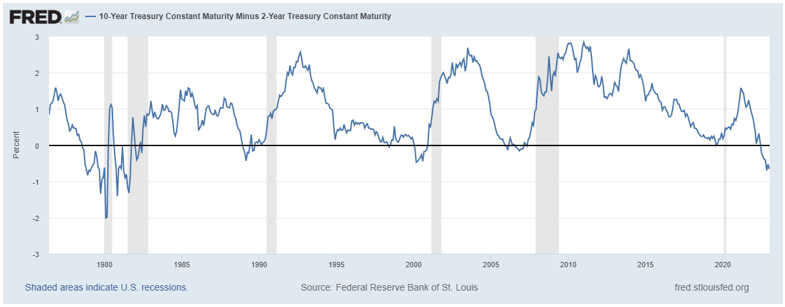

Throughout last year we steadily increased our forecast probability that the economy had already, or would soon, enter a recession. More recently, as policy remains targeted on slowing activity to address inflation while real-time conditions exhibit spreading pain, we think the odds of a hard-landing scenario increase. Conversations with people operating in different segments of the economy reinforce this view with fewer comments saying things are going strong, balanced against a growing number observing various signs of weakness. Financial markets as well are increasingly discounting this scenario. One of the most often cited and frequently accurate predictors of a coming recession is an inversion of the yield curve. This is when interest rates for short-term borrowing are higher than those further in the future. The difference between the 10-year and two-year U.S. Treasury currently shows a level of inversion not seen since 1981 (shaded areas are recessions.)

While this paints a very gloomy outlook the point here is more to reflect on where we are and what may be discounted in financial markets. We believe interest rate policy has been one of the most significant factors driving financial markets of late and while the current posture is very hawkish, things can change. Looking back to December 2021, the Fed’s forecasted Funds Rate for 2022 was just 0.9%. Markets seem to hang on every utterance Fed members make, though history has shown their crystal ball is hardly perfect. We think slowing economic activity and moderating inflation could significantly alter their hawkish stance later this year. A shift in this direction would likely prove to be less adversarial for financial markets and help the bond market avoid a repeat of the disastrous conditions of 2022.

Inflation was the big theme for 2022 and it drove the policy capitulation from post-COVID accommodation to tightening at every turn. However, inflation, as tracked by the Fed, is a rate of change measure and as comparisons start to lap higher price levels from last year it becomes easier for the rate of change to begin to recede. This doesn’t mean price levels are returning to pre-2022 levels, just that the rate of increase has moderated. The slowdown in the economy, improvement in some supply chain challenges, and the decline in energy prices can all contribute to less pressure on the rate of price hikes.

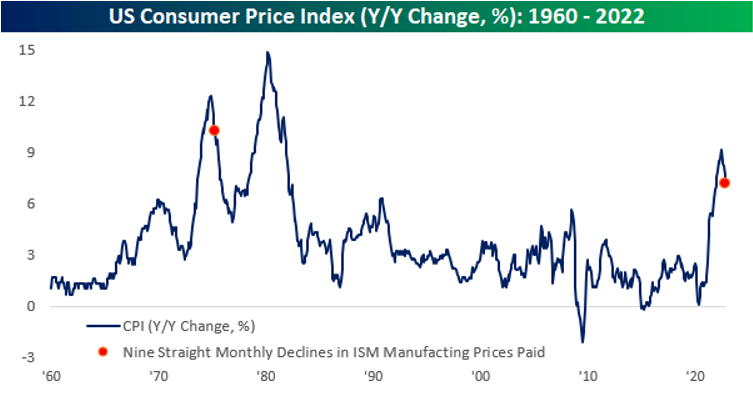

This taper in the rate of CPI readings actually began in the second half of 2022. The CPI year-over-year reading reached a peak of 9.0% in June and then declined to 7.1% by November (data reported in December). Within this data, one of the larger and slower-to-react variables is housing and shelter. Recent data on home prices and apartment rents suggest the rate of increase from that component will at least flatten out in the coming months, if not see an outright contraction. The chart below from Bespoke Investment Group shows past examples of how CPI levels can recede after a sharp spike.

We believe a less hot inflationary environment could give the Fed more latitude with monetary policy with the initial result either a pause in rate hikes and/or a reduction in the terminal target rate. Signals of this sort would most likely be viewed favorably by markets. In our opinion, it would also make sense to allow the lag effects of monetary policy to work through the economy. Changes to the economy from monetary rate adjustments typically take time to be felt, anywhere from 12 to 18 months. Considering how significantly and fast the rate adjustments have been made there are still ramifications that are likely yet to be fully realized. Even in housing, where changes impacted sales right away, the full impact where pricing and sales volumes find an equilibrium probably remains to be seen.

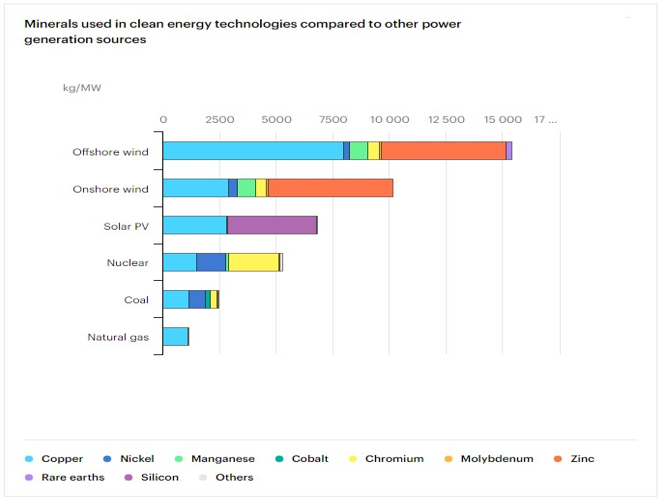

However, even if we realize a cooling in the rate of inflation, we think the next decade will see higher inflation than the past decade. The structural changes from energy initiatives and geopolitical shifts in the world economy are two examples that will involve higher costs in the future. Implementing green energy sources involves relying on power sources with less energy density than fossil fuels, meaning the upfront investment to substitute a similar level of power output will be significant. Many of the inputs for this transition require high-energy inputs to mine and process. This includes the requirement for large amounts of rare elements which could cause the prices of the commodities to rise substantially. The chart below from IEA illustrates the amount of commodities and rare minerals needed for various forms of power generation.

Ramifications from the political split brought on by the Russian war will also have long-term implications for how the global economy operates. For the most part, counties aligned with Russia and China have supplied the world with growing amounts of basic commodities and inexpensive labor over the past decade. Replacing those inputs generally will involve higher costs. Many companies are now reevaluating global supply chains and manufacturing operations. Among the many, Apple indicated it is looking to move a significant amount of its Chinese-based manufacturing to other countries, including India and Vietnam. Even if Apple can achieve similar cost and yield structures in these new markets, the effort to transition its volume of manufacturing will be substantial. Other companies that may choose reshoring operations here in the U.S. may provide a boost to our economy, but it is unlikely to reduce the cost of the final product.

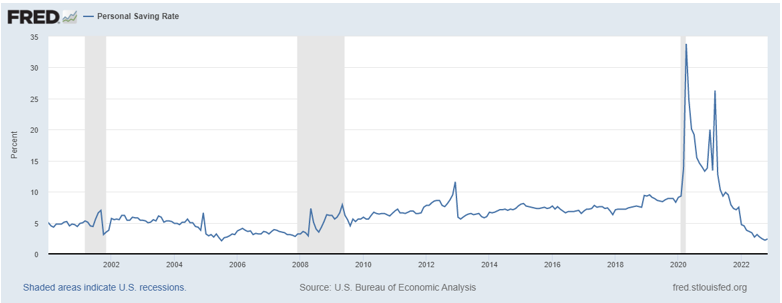

A major reason there remains a debate about whether a recession could involve a soft landing or hard landing is that, so far, employment has held up surprisingly well. The monthly jobs reports in 2022 surpassed expectations almost every month and are currently trending with over 200,000 new jobs added per month. At the same time, the unemployment rate is at a low of 3.5%. This comes in the face of many announced job reductions in the real estate, technology, and consumer discretionary sectors. Changes in employment trends are usually a lagging indicator relative to economic changes but it is one of the key variables the Fed is watching to set policy. So far, the Fed has clearly stated a strong jobs market is viewed as a contributor to inflation risk. We would add that whether this resiliency can hold up could be a significant factor in how severe any recession becomes. Data suggests the consequences of inflation have drawn down consumer savings to levels not seen in more than a decade (chart below) while at the same time, consumer credit usage has risen significantly. If unemployment does begin to pick up, consumers appear to have little relative safety net.

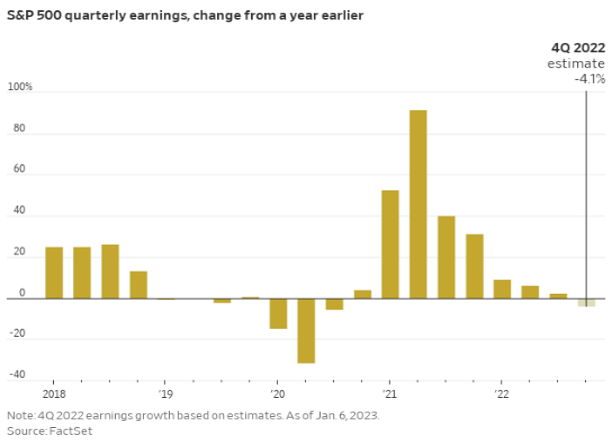

Regardless of how the economic environment is termed, markets have begun to factor in growth and profit pressures. Corporate earnings for the fourth quarter will be released over the next several weeks and provide color not only on how 2022 finished up, but also importantly, the view on 2023. The following chart shows S&P500 earnings expectations down year over year for the fourth quarter, the first annual decline since COVID. Currently, the view is for a modest contraction of 4%, though the change in this estimate over the past month has seen a larger downward revision than for the previous quarters in 2022. The implication is that the market is getting more aggressive about factoring in slowing conditions, the question remains as to whether it is enough. According to Factset, analysts are still projecting earnings growth of almost 5% and revenue growth of over 3% in 2023, which still feels a bit optimistic given the current environment.

Although this letter has focused on the many challenges facing the economy and markets, as is almost always the case, many things can still go right. For starters, the decline in 2022 in both stocks and bonds was significant by historical standards, meaning that further declines take even more bad news. Back-to-back down years for either stocks or bonds is fairly rare. Since 1950, for stocks, it has only happened during the early ‘70s and again in the ‘00s in the wake of the dot-com bubble. The Financial Crash of 2008 was bordered by positive returns on either side. Looking at other past patterns, the Presidential cycle is also in the market’s favor, with the third year of a term historically having a high likelihood of positive performance.

Empirically, inflation pressures may be less punishing in 2023. We don’t think price levels will be falling or the normalized rate to fall back to less than 2%, but the monthly rate of change may see retrenchment from the surges of 2022. Energy prices should help this. Oil and natural gas are significantly off their highs of last year and this relieves input, transportation, and consumption cost pressure. Several of the worst-case scenarios from the energy crunch last year (diesel fuel, heating oil, Europe) have so far been averted. Meanwhile, earnings estimates have been ratcheted down at a faster clip, implying that more bad news is being priced into markets. In our opinion, all these conditions could support a shift in Fed policy to at least be less frantic with rate hikes and hawkish commentary.

Implementing these views into portfolio strategies has been a migration rather than a wholesale reallocation. (as we discuss strategies please not that this is a broad discussion and should not be interpreted as a recommendation for the purchase or sale of any asset class and may or may not be relevant to your situation) A portion of cash raised through sales last year went to the direct purchases of short-term (two-year or less) U.S. Treasuries, something we have rarely done in the past. In this situation, we viewed these securities as a good balance of income and safety during a period of heightened uncertainty. We have tended to focus on value and dividend potential in the current environment. Additionally, we made additions to a few of the active mutual funds we have held for a while that employ either a hedged equity or a long/short strategy. These funds have very strong defensive characteristics, and we were very pleased with how they performed in a very difficult year. We will likely continue to utilize assets like this as the market works through uncertain economic times. In our opinion, holding assets like this is a hedge against the approach of going entirely to cash as this strategy has its own risks in periods of high inflation.

Our strategies are expected to continue to look to holdings of real assets. We have had gold in strategies for a long time and it has generally delivered offsetting performance to equity market risk. Last year saw a selloff from the highs around the time of the Russian invasion, but the asset still managed to finish roughly flat for the year which was far better than most alternatives. Energy and other commodities also were relative outperformers and we have more holdings among these assets in strategies than in years past. We think gold and other real assets will continue to see improved desirability in the face of conditions that will challenge most currencies. The U.S. Dollar was a relative gainer in 2022 as a safe haven from other risks but there could be challenges on the horizon as unending large deficits balloon the total U.S. Debt. At some point, we believe interest rate policy may have to factor in the budgetary interest expense burden that comes from higher rates on a larger debt balance.

The aggressive move higher in interest rates last year did at least part of the job intended by finding an inflection point in the rate of inflation. The question is what are the costs? Housing, tech, and car sales have all experienced a material negative impact. What remains to be seen is the degree of impact on other lagging factors, such as business services and employment. In our opinion, how the Fed manages this transition will be an important factor in what the economy and markets look like in 2023. Other variables, like the structural changes in resource supply and global trade, are more likely to be variables we all have to adapt to in the future. We believe navigating that adaptation will involve managing higher costs and are planning accordingly. As these developments unfold, we will continue to communicate any changes in our view and corresponding implications for client allocations. We thank you for your continued trust in us and hope you and your family remain in good health.

Bradley Williams, Chief Investment Officer

Lowe Wealth Advisors

Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by Lowe Wealth Advisors, LLC), or any non-investment related content, referred to directly or indirectly in this newsletter will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this newsletter serves as the receipt of, or as a substitute for, personalized investment advice from Lowe Wealth Advisors, LLC. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his/her situation, he/she is encouraged to consult with the professional advisor of his/her choosing. Lowe Wealth Advisors, LLC is neither a law firm nor a certified public accounting firm and no portion of the newsletter content should be construed as legal or accounting advice. A copy of the Lowe Wealth Advisors, LLC’s current written disclosure statement discussing our advisory services and fees is available upon request. If you are a Lowe Wealth Advisors, LLC client, please remember to contact Lowe Wealth Advisors, LLC, in writing, if there are any changes in your personal/financial situation or investment objectives to review/evaluating/revising our previous recommendations and/or services.