The investment landscape has followed a remarkable path over the past several years, and interest rates in particular. Despite countless forecast to the contrary, most market interest rates have continued to trend lower. Now more recently a growing array of deposit accounts and fixed income securities have moved through what was thought to be a natural barrier of 0%. A product of aggressive central bank interventions, low inflation expectations and currency volatility has resulted in one of the most important elements of finance reversing is cost / benefit role.

Mainly a characteristic of European debt markets at this point, the total amount of capital in negative rate structures is nonetheless large ($4 trillion – Wall Street Journal) and has been expanding. Slow growth and deflation risks justify for some investors the prospect of certainty in minor negative return, but also reflect a diminishing set of alternatives at a reasonable risk / return trade-off. The conditions fostering this environment are further complicated by continued interest rate cuts by central banks around the world – more than 15 rate reduction actions so far this year.

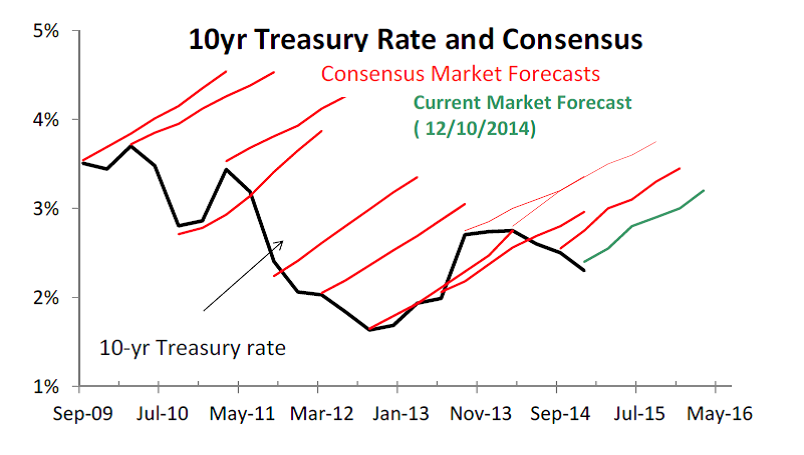

Negative rates have not extended to U.S. investors, but they speak to some of the headwinds facing our Fed in attempting to “normalize” our interest rates. Once again, economists are highly certain U.S. interest rates will begin rising later this year. This note isn’t a prediction of that error, but a reminder that we have seen this movie before (see graph) and a note of the challenges to that end. In addition to falling comparable international interest rates, the Fed will also have to balance some weakening economic data here (energy sector, in particular), significant gains already made by the U.S. dollar and the present low inflation expectations.

As a consequence, we expect the interest rate environment for U.S. investors to remain challenging for some time to come. The Fed may or may not attempt to raise the U.S. short term rates later this year, but even if they do so, rates will probably go up at a slower rate than the consensus has reflected. We expect rates at depressed levels will continue to push valuations for other assets to ranges considered high by their historical standards, but recognize this as the product of years of aggressive stimulation by central banks around the world. Our objective remains to find the best perceived risk-adjusted opportunities given the economic landscape, and fortunately for us that keeps investments with stated negative returns well off our radar screen.

Lowe Wealth Advisors is an SEC registered investment adviser that maintains a principal place of business in the State of Maryland. The Firm may only transact business in those states in which it is notice filed or qualifies for a corresponding exemption from such requirements. For information about the registration status and business operations of Lowe Wealth Advisors, please consult the Firm’s Form ADV disclosure documents, the most recent versions of which are available on the SEC’s Investment Adviser Public Disclosure website at www.adviserinfo.sec.gov.

This commentary is intended for the dissemination of general information regarding market conditions to Lowe Wealth Advisors clients. The information contained herein should not be construed as personalized investment advice. Past performance is no guarantee of future results, and there is no guarantee that the views and opinions expressed in this report will come to pass. While any general market information and statistical data contained herein are based on sources believed to be reliable, we do not represent that it is accurate and should not be relied on as such or be the basis for an investment decision. Any opinions expressed are current only as of the time made and are subject to change without notice.