According to data just released by the Treasury Department the U.S. budget deficit topped $1 trillion through the first 11 months of the current fiscal year. The figure exceeds the official forecast and adds to the nation’s growing debt balance, which is now in excess of $22 trillion. The gap is especially noteworthy as the U.S. expansion is now the longest on record at 122 months according to The National Bureau of Economic Research (NBER).

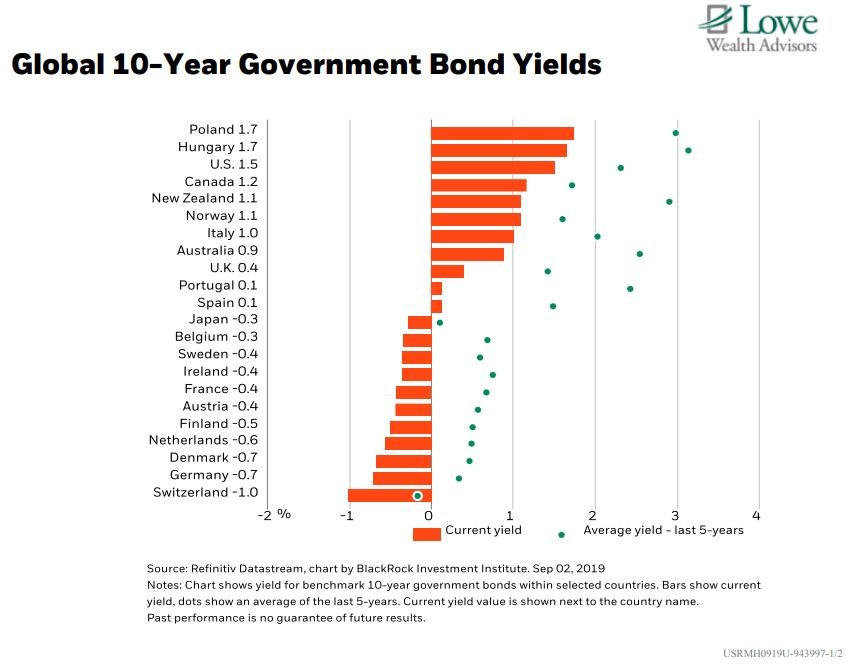

Some economic models predict increased government debt should crowd out other borrowers and the cost of credit (interest rates) will increase. The current environment has witnessed anything but as proliferate deficit spending globally is juxtaposed against historically low, and in more cases, negative interest rates. Globally, policymakers have fostered this through stimulus programs that print money, buy securities in the open market and suppress interest rates, including pushing levels below zero in many countries (see graph).

The policy theory expects investors to avoid negative rates (cost to hold a bond rather than receiving interest payments) and instead spend or invest the capital thereby increasing economic activity. However, the evidence of success relative to other costs is difficult to quantify and none of these programs have demonstrated an ability to withdraw the stimulus contributions, even in periods of economic growth.

So, who is buying these negative-yielding bonds and why? At this time, we believe primarily institutional bond investors with the idea that if the rates become more negative, the value of the bond will increase resulting in a capital gain. Bond prices move inversely to the change in market interest rates and capital gains could offset the costs of a negative yield resulting in a trading profit. However, there is substantial risk if market rates increase, as the prices could quickly turn to capital losses on these bonds.

Thus far, the U.S. has avoided using negative rates, though the proclivity of policymakers to like using stimulus tools leaves us a little concerned. In our opinion, negative interest rates undermine the basic tenants of capitalism where sound investments are rewarded real returns. They also disrupt business models essentially to everyday commerce including insurance, pensions, and lending. Coupled with a large deficit and debt situation that appears to concern few leaders, the mix is one we believe could weigh significantly on future growth prospects.

Bradley Williams, Chief Investment Officer

Lowe Wealth Advisors

Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by Lowe Wealth Advisors, LLC), or any non-investment related content, made reference to directly or indirectly in this newsletter will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this newsletter serves as the receipt of, or as a substitute for, personalized investment advice from Lowe Wealth Advisors, LLC. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his/her individual situation, he/she is encouraged to consult with the professional advisor of his/her choosing. Lowe Wealth Advisors, LLC is neither a law firm nor a certified public accounting firm and no portion of the newsletter content should be construed as legal or accounting advice. A copy of the Lowe Wealth Advisors, LLC’s current written disclosure statement discussing our advisory services and fees is available upon request. If you are a Lowe Wealth Advisors, LLC client, please remember to contact Lowe Wealth Advisors, LLC, in writing, if there are any changes in your personal/financial situation or investment objectives to review/evaluating/revising our previous recommendations and/or services.