Crosscurrents following the June Fed meeting have been significant, particularly given there was no change to existing rate policy. Market expectations anticipated a more dovish policy stance, and the shift was consistent citing slower economic growth and weaker business investment. While there was no action at this meeting, the Fed all but confirmed it would be cutting rates at its next meeting in July and likely again before the year is out.

President Trump was underwhelmed and made suggestions of firing or replacing Fed Chair Powell. His goal would seem to be a more stimulative monetary policy and to cut the value of the dollar. The administration has viewed the highly stimulative policies of other central banks as a trade threat and has indicated a desire to devalue the dollar to compensate. The market is now seeing significant pressure on U.S. monetary policy with risk of escalation into a full currency war.

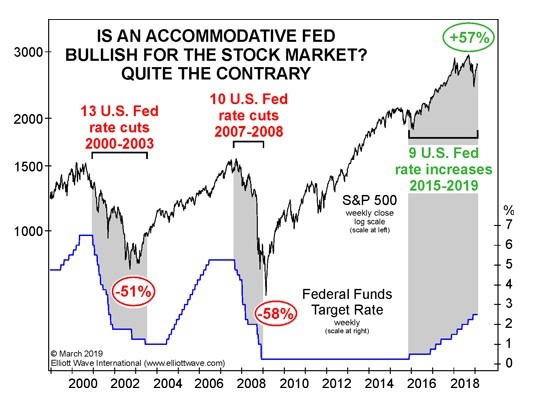

Lower rates are frequently viewed as positive for stocks. However, when policymakers are cutting rates, it is often because the economy is facing more risks. Stocks have historically seen poor returns when central bankers are cutting rates. Consequently, we view this as a somewhat precarious moment to be embracing the idea of lower rates as great news. Stocks are near all-time highs while signs of slowing economic growth are mounting. It is possible that aggressively cutting rates could squeeze a little more time out of the economic expansion. The other side of the equation is that you risk devaluing the currency and limiting response options should conditions slow further.

As the risks are rising, financial markets are responding. Interest rates are again falling to historic lows as capital looks for safety in bonds and gold. The latter has risen to its highest price in five years as some look for a hedge to policy error or currency devaluation. Of these, we note gold is particularly interesting as it crosses price resistance in effect for more than five years. Recently, gold as a portfolio asset has been largely overlooked. Many investors are just now considering whether they want to add a risk-averse asset to their portfolio. In our opinion, this would be supportive of still higher prices.

IMPORTANT DISCLOSURE INFORMATION

Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by Lowe Wealth Advisors-“Lowe”), or any non-investment related content, made reference to directly or indirectly in this blog will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this blog serves as the receipt of, or as a substitute for, personalized investment advice from Lowe. Please remember that if you are a Lowe client, it remains your responsibility to advise Lowe, in writing, if there are any changes in your personal/financial situation or investment objectives for the purpose of reviewing/evaluating/revising our previous recommendations and/or services, or if you would like to impose, add, or to modify any reasonable restrictions to our investment advisory services. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his/her individual situation, he/she is encouraged to consult with the professional advisor of his/her choosing. Lowe is neither a law firm nor a certified public accounting firm and no portion of the blog content should be construed as legal or accounting advice. A copy of the Lowe’s current written disclosure Brochure discussing our advisory services and fees is available for review upon request. Please Note: Lowe does not make any representations or warranties as to the accuracy, timeliness, suitability, completeness, or relevance of any information prepared by any unaffiliated third party, whether linked to Lowe’s web site or blog or incorporated herein, and takes no responsibility for any such content. All such information is provided solely for convenience purposes only and all users thereof should be guided accordingly.