What a Difference A Year Makes

January 17, 2020

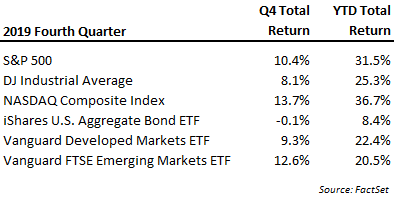

Stock markets around the world enjoyed a strong showing in the fourth quarter to wrap up a healthy year of gains. In 2018, all asset classes other than cash saw negative returns, while this past year saw gains in all asset classes. Returns were stronger for U.S. stocks versus international markets and within our markets, big companies and those in the tech sector generally saw the largest gains. Interest rates, which had been heading higher in 2018, reversed coincident with policy changes and moved steadily lower through most of 2019. The decline in interest rate drove capital gains in bond markets and led the overall fixed income index return to more than 8%.

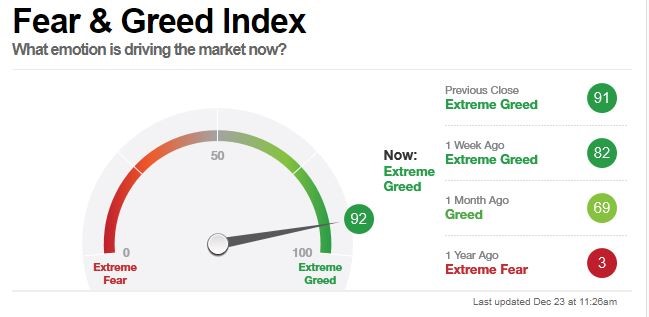

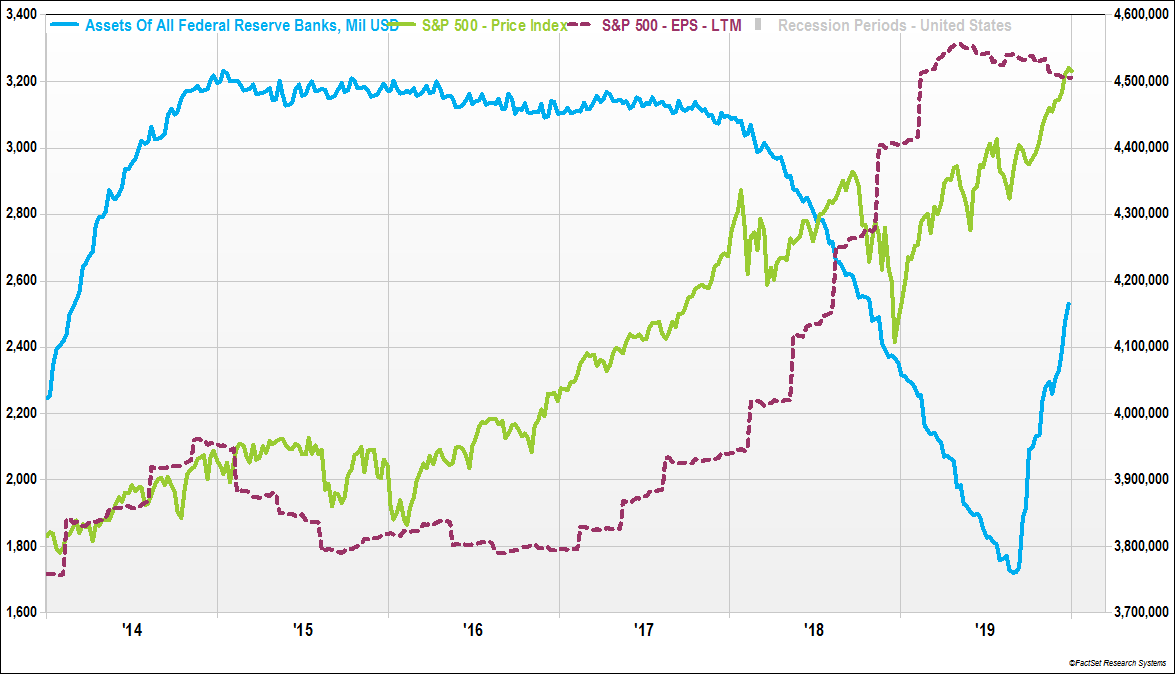

The contrast to the prior year (2018) was most stark in the final quarter of the year. In 2018 the S&P500 was down almost -14% in the fourth quarter while this past year it gained more than 10% during the same period. In 2018 investors were concerned about Fed tightening – raising interest rates and contracting their balance sheet (increases reflect injections of money into financial markets) while in 2019 the Fed restarted rate cuts and then in the fourth quarter resumed the expansion of its balance sheet. By the end of 2018, investors could hardly be more pessimistic. By the end of 2019, that picture reversed as well and by some measures left little room to become even more optimistic. The graphic below is a popular sentiment gauge from CNN and measures current optimism along with past comparison points. This shot was taken on December 23, 2019, a day removed from the one-year anniversary of the market low in 2018.

The acceleration in market appreciation in the fourth quarter can be closely linked with the Fed’s announcement in early October to resume financial market stimulus. After some minor volatility in the overnight cash lending market, referred to as the REPO market, the Fed began a new program of asset purchases to stabilize these ultra-short-term rates. While the Fed has been circumspect around the exact need for this latest stimulus, it nonetheless indicated it would continue to provide support at least into early 2020. Though Fed officials went out of their way to avoid the label of QE4 (Quantitative Easing, 4th round), as can be seen on the graph below, the blue line showing Fed assets on their balance sheet is increasing as it did in prior rounds of QE.

This latest round of stimulus has further kicked up the excitement in the stock market but, in our opinion, opens the possibility to some rather negative repercussions. Most immediate would be the need to sustain the aggressive rate of securities buying – new injections are occurring at a pace not seen since 2011 when the economic outlook was far healthy. As can be seen in the graph above, the stimulus since October has undone about a year’s worth of balance sheet contraction (stimulus removal). If the Fed maintains the current rate of purchases, assets held on the Fed’s balance sheet could be hitting a new high by mid-2020. In our view, this rate of stimulus expansion cannot be maintained for long. A tapering or elimination of the recent program runs the risk of removing a clear tailwind that we believe has contributed to recent market appreciation.

If the asset-buying does continue apace, we believe there may be other risks, including a devaluation of the U.S. Dollar. The surge in securities purchases by the Fed has coincided with high levels of U.S. Treasury issuance at a time when foreigners are buying less of our government debt. If a primary necessity for running the asset purchase program is to stabilize the demand side of government debt issuance, we are essentially looking at debt monetization.

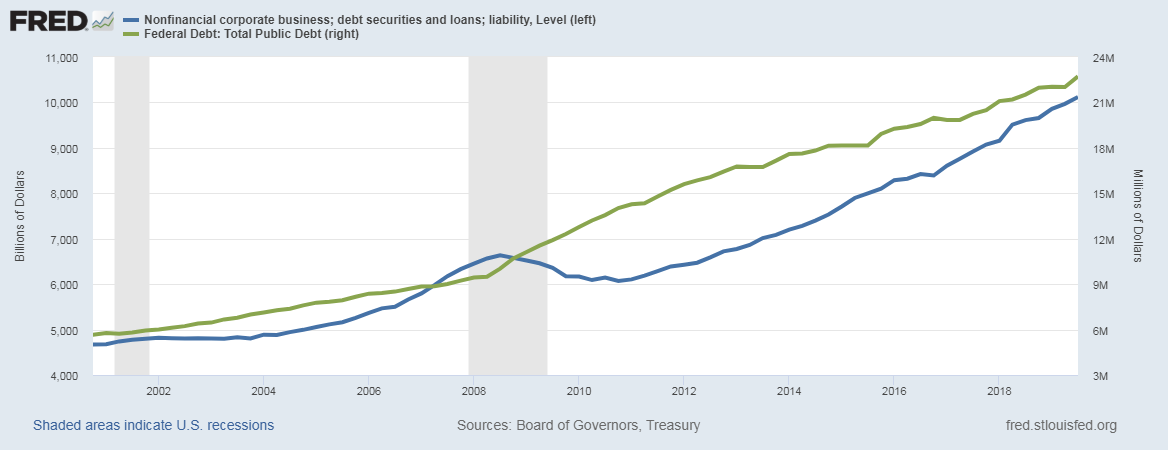

Debt monetization (printing money to fund deficits) could undermine the value of our currency and lead to inflation that may be difficult for the Fed to manage. Even if not directly happening now, we are concerned things are moving in this direction as Washington has renounced any need for fiscal restraint, even as deficits top $1 trillion annually. Further, the trillion-dollar deficit figures are happening during an economic expansion and almost surely would rise significantly higher in any material economic slowing. Suppressed interest rates offer seemingly little downside to increased leverage – a path governments (green line) and businesses (blue line) have taken aggressively during this cycle of falling rates – but the rising debt loads could be very problematic in an economic slowdown.

High debt levels may not be the spark that causes volatility or an economic downturn, but it is a condition that can contribute to the length and severity of a financial disruption. Low interest rates make it easier to push concerns and challenges off to the future but dealing with current issues through more borrowing will not solve structural problems. Cutting rates can stimulate markets but does not ensure a rising market. In 2008 the Fed cut rates rapidly, moving seven times from 4.25% to 0.25%, but this did not prevent a major decline for stocks.

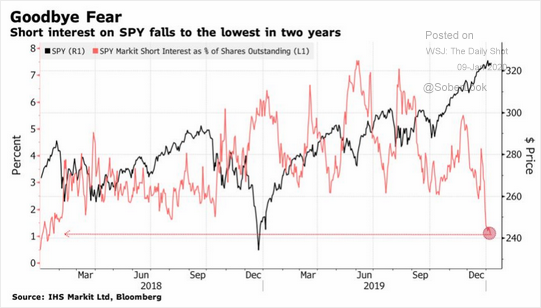

In our opinion, the latest stimulus action by the Fed is acting as an accelerant on riskier financial assets because the fear factor is low. Uncertainty has lessened some with “Phase One” of the Chinese trade deal reached while macro events such as Iran seem to come and go quickly with little market impact. It also helps that economic conditions are generally stable – not overly strong but better than conditions which had recession talk perking up in the middle of last year.

Economic growth in the U.S., adjusted for inflation, was approximately 2.3% in 2019 and compares to GDP (Gross Domestic Product) growth of 2.9% in 2018 (U.S. Department of Commerce). The cycle expansion remains intact, albeit at progressively lower rates, including current projections for 2020 estimating growth at 1.9%. The growth story has remained fairly consistent with the strongest consumer activity generally the strongest while manufacturing has been the weakest within the business sector.

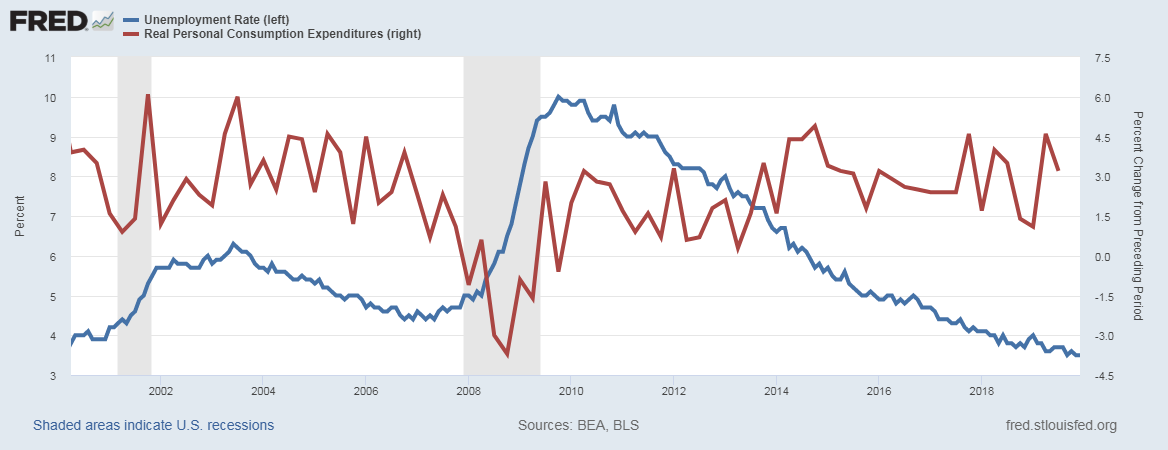

The relentless gains in the jobs market have supported consumer activity and been a key driver in the duration of this expansion, the first U.S. growth cycle in history to cover a calendar decade without a recession. After peaking at 10.0% in October of 2009, the unemployment now sits at 3.5% (blue line), a level not seen since the late ‘60s. While employment alone is a lagging indicator to predict economic growth, personal consumption can provide some leading information and the current consumption growth rate in excess of 3.0% (red line) remains well above past pre-recessionary levels.

Resolution on the first phase of a trade deal with China likely helps the economic outlook incrementally, but we remain skeptical of the degree or longevity this agreement offers. First, details of the agreement are limited, casting some doubt on just how substantial the benefits might be. Some speculation has suggested the amount of agricultural trade covered under the deal may just take us back to levels seen prior to tariff disruption. Second, while a limited agreement could have been beneficial in settling the waters of trade uncertainty, the volatile on-again, off-again game leading to the pact probably undermines any incremental confidence businesses might gain in planning for the future. The equity market made many advances on the various headlines concerning this trade progress, but again we think this is more a product of the very bullish sentiment than the fundamental benefits of the deal.

Confidence or sentiment is a condition in markets and can accentuate moves higher and lower. As noted earlier, in late December of 2018 sentiment was about a low as it gets and even though growth trends were little changed, the interpretation of most news during that period was negative. By many measures, we see current conditions at the other end of the spectrum – very optimistic, as in Teflon-strong – no bad news sticks. As an example, investors are foregoing the protection of put buying at a rate last comparable to January 2018, just prior to the volatility driven selloff experienced that month. More recently, we have observed activity that could be described as frothy. Signs of a robust appetite for speculation include concentrated returns in select large-cap stocks (e.g. Apple), big daily dollar price moves in high-profile stocks, analysts promoting large price target opportunities justified by little change in fundamentals and a resurgence in beaten-up assets like Bitcoin and marijuana.

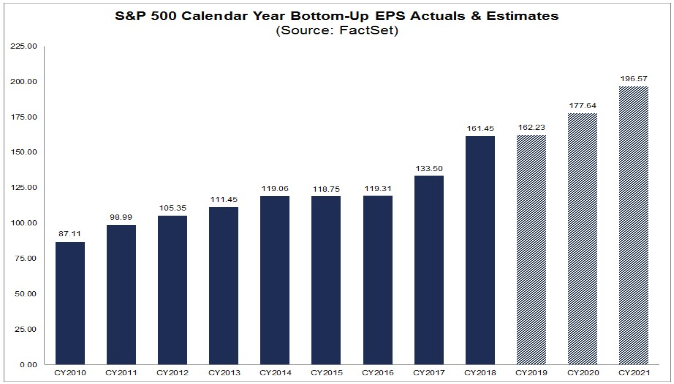

Even though investor confidence is robust at the moment, it’s not likely that stocks won’t face some identifiable challenges this year. Corporate earnings growth stalled in 2019 after big gains in 2018 and while there is a projected pick-up in 2020, hitting those targets may be a bit more difficult. We believe achieving the 2020 earnings estimates will be challenged by a lack of major catalysts and the tepid global growth picture. In 2018, the tax cut was a major boon to large companies while earnings also benefited from steady costs and ongoing stock buybacks. Companies are still very actively taking on debt and reducing share count through repurchases, but there is no new tax cut on the horizon. Further, operating costs, which generally held steady for a long time have shown some signs of moving higher, both for labor and raw materials. The increase in costs have not been significant enough to raise inflationary concerns, but the trend works against the margin expansion gains companies have seen in prior years.

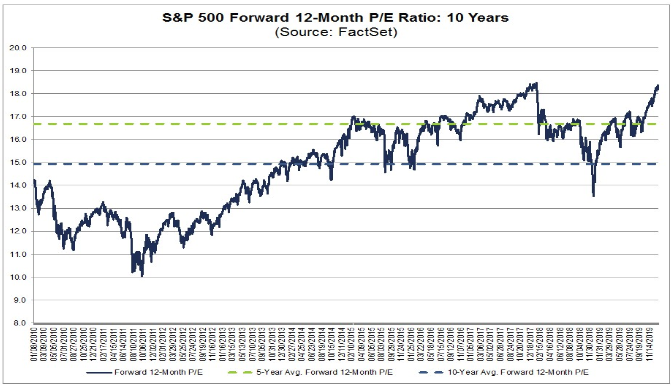

If earnings don’t begin to show an acceleration off the plateau seen in 2019 the market may face more questions about valuation. The previous chart shows earnings in 2019 (not yet finalized) were basically flat with 2018 making the primary driver of the 30%+ stock gain in 2019 a product of multiple expansion. Exceptionally low interest rates have been used for years now to justify higher valuation multiples on stocks, but even so, stock’s valuation on earnings are at the high end of the range seen during this cycle. The chart below shows the current forward price-to-earnings multiple near the high point reached in early 2018. Valuation is not an effective tool for timing buys and sells but does indicate the margin of safety or risk investments may offer if and when conditions change.

Another known unknown for financial markets in 2020 is the U.S. election. Regardless of one’s predicted or favored victor, it’s difficult to not imagine many swings to come in the polling among the various candidates. For financial markets, some of those candidates bring with them the potential for more disruption than others. The coming months will host key primary and caucus events that may offer a clearer indication of the leading candidates and more details on the costs of their platform. None of the candidates are running on a platform of financial prudence which makes the growing deficit and debt issue a seemingly unavoidable problem at some point. In our opinion, scenarios that would increase spending faster and sooner could result in a more immediate negative impact on markets.

Though the challenges and uncertainties are many, the financial markets have remained remarkably resilient. Sustained economic growth, albeit slight, along with monetary authorities that have demonstrated a willingness to step in to support even minor disruptions have emboldened investors to look past a multitude of risks. The recent actions by the U.S. Federal Reserve have demonstrated a new level of aggressiveness and leave open the question of how far they can go before tougher questions get asked. In our opinion, the more recent observations of frothy market behavior raise the question as to whether policymakers are once again attempting to support or bailout one group only to risk fomenting a larger, risk-taking bubble. The current landscape increases our confidence in holdings some hedges like precious metals and high-grade, short-term fixed income against these risks. How the paths of stimulus, growth and the election develop may prompt a further step in defensiveness as the year progresses. As these developments unfold, we will continue to communicate any changes in our view and corresponding implications for client allocations.

Bradley Williams, Chief Investment Officer

Lowe Wealth Advisors

Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by Lowe Wealth Advisors, LLC), or any non-investment related content, made reference to directly or indirectly in this newsletter will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this newsletter serves as the receipt of, or as a substitute for, personalized investment advice from Lowe Wealth Advisors, LLC. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his/her individual situation, he/she is encouraged to consult with the professional advisor of his/her choosing. Lowe Wealth Advisors, LLC is neither a law firm nor a certified public accounting firm and no portion of the newsletter content should be construed as legal or accounting advice. A copy of the Lowe Wealth Advisors, LLC’s current written disclosure statement discussing our advisory services and fees is available upon request. If you are a Lowe Wealth Advisors, LLC client, please remember to contact Lowe Wealth Advisors, LLC, in writing, if there are any changes in your personal/financial situation or investment objectives for the purpose of reviewing/evaluating/revising our previous recommendations and/or services. (Note: this is not a recommendation to purchase any asset class and commodities can carry risks that are not appropriate for all investors)