Lowe Wealth Advisors is pleased to provide you with an economic update and overview from Anirban Basu. We hope you find the information helpful.

It’s All about Inflation or Lack Thereof

Written by Anirban Basu, Sage Policy Group

August 2017

Asset Prices Soar as U.S. Enters Ninth Year of Expansion

It’s all about inflation or the shocking lack thereof. After more than eight years of economic recovery and with the nation hurtling towards full employment, one might think that significant inflationary pressures would have become apparent by now. Indeed, life is becoming more expensive, whether in the form of rising home prices, tuition, healthcare costs, or labor. But for whatever reason, worrisome inflation has failed to manifest itself in the data, including the data scrutinized most intensely by Federal Reserve policymakers.

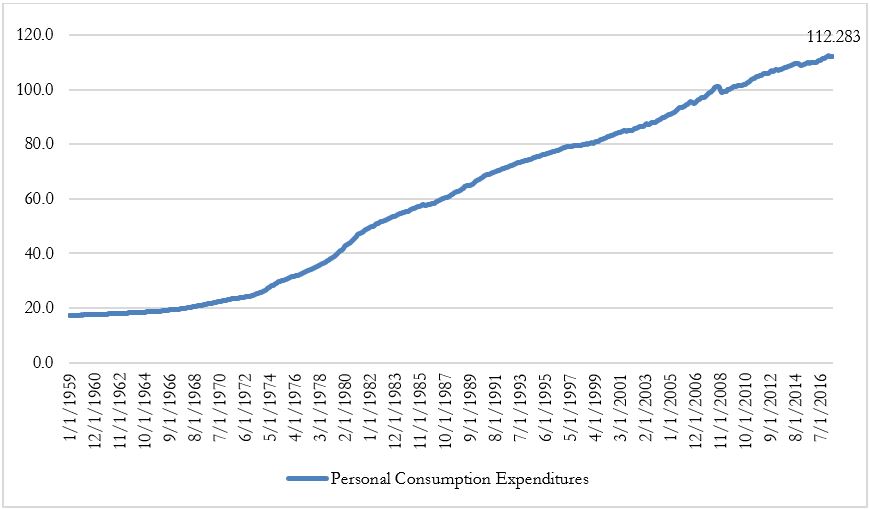

The Federal Reserve’s preferred measure of inflation, the core personal consumption expenditures (PCE) index, was up a minuscule 0.02 percent on a month-over-month basis in June. On a year-over-year basis, this measure is up 1.42 percent, well short of the 2 percent target established by the Federal Reserve.

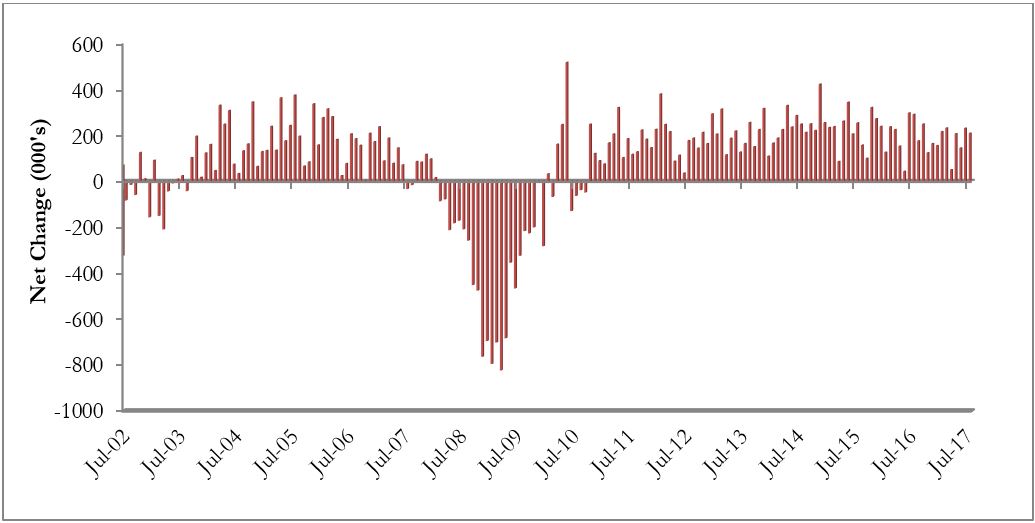

This is remarkable given that U.S. unemployment stands at just 4.3 percent, a 16-year low. Employers in construction, trucking, manufacturing, leisure/hospitality, and in many other segments continue to complain about a dearth of qualified talent. According to the government’s most recent Job Opportunities and Labor Turnover Survey, America is home to 6.2 million job openings. That represents the highest number since the U.S. Labor Department began monitoring job postings in 2000. There are 7 million unemployed Americans, which means that there is almost one job for every person searching for one.

This is remarkable given that U.S. unemployment stands at just 4.3 percent, a 16-year low. Employers in construction, trucking, manufacturing, leisure/hospitality, and in many other segments continue to complain about a dearth of qualified talent. According to the government’s most recent Job Opportunities and Labor Turnover Survey, America is home to 6.2 million job openings. That represents the highest number since the U.S. Labor Department began monitoring job postings in 2000. There are 7 million unemployed Americans, which means that there is almost one job for every person searching for one.

The implication is that one might anticipate rampant wage inflation under such circumstances. But average hourly earnings are up just 2.5 percent on a year-over-year basis, well short of the roughly 3.5 percent rate one might expect from a solidly performing economy. True, employees are working longer hours on average than in prior years, which translates into average wage and salary growth above 2.5 percent. Still, the overall impact on inflation has been sufficiently benign to allow the Federal Reserve to tread lightly.

Interest rate increases have been sporadic and America’s central bank has just recently begun to discuss the processes by which it will ultimately shrink its balance sheet. As of now, total assets of the Federal Reserve remain in the range of $4.5 trillion.

The lack of troublesome inflation explains far more than Federal Reserve policymaking. When inflation is low, interest rates tend to be low, including mortgage rates, rates attached to auto loans and credit cards. The result is that consumers are re-leveraging after deleveraging several years ago. The U.S. savings rate is once again below 4 percent.

Last year represented a record year for new vehicle sales in America. Home prices are rising rapidly in many communities in the context of interested buyers and dwindling inventory. Low inflation and interest rates also explain the weak performance of gold, which once stood at more than $1,900/ounce but has recently struggled to remain above $1,300/ounce.

Low-interest rates in the U.S. and in many parts of the advanced world also help explain the seemingly insatiable appetite for equity, commercial real estate and other assets. The result is a Dow Jones Industrial Average that surpassed the 22,000 level in early-August. The NASDAQ and S&P 500 have also routinely been setting records. Low-interest rates have helped support a high multiple on corporate earnings, which recently have been surprising to the upside.

Looking Ahead

The U.S. economy continues to expand and there is little reason to believe that the economy will fail to enter 2018 in decent shape. Job growth continues to be brisk and has helped induce more people into the labor force. The global economy has firmed since last year, with better performances being delivered by nations like Japan, Brazil, and Russia. Several European nations have also experienced improved performance. All of this has helped to support corporate earnings.

However, one could argue that asset prices have recently risen by far more than is justified by shifting economic fundamentals. Among other things, this has translated into an S&P 500 P/E ratio approaching 25 Commercial real estate valuations have also raced higher, leading to another round of construction of hotels, office buildings, and other commercial structures. The implication is that there could be some risk to the downside, particularly if inflationary pressures become apparent and force the Federal Reserve to act with more urgency. Add in dollops of political intrigue emerging from Washington, D.C. and Pyongyang, and the message is that one should tread carefully at a time of elevated asset prices.

For more information about Lowe Wealth Advisors and how we seek to manage various risks please visit our website at www.lowewealth.com.

Important Disclosure Information

The opinions of Sage Policy Group and Anirban Basu do not necessarily reflect the views of Lowe Wealth Advisors nor are they recommendations to take any specific action. Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by Lowe Wealth Advisors, LLC (“Lowe”), or any non-investment related content, made reference to directly or indirectly in this commentary will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this commentary serves as the receipt of, or as a substitute for, personalized investment advice from Lowe Wealth. Please remember to contact Lowe Wealth, in writing, if there are any changes in your personal/financial situation or investment objectives for the purpose of reviewing/evaluating/revising our previous recommendations and/or services, or if you would like to impose, add, or to modify any reasonable restrictions to our investment advisory services. Lowe Wealth is neither a law firm nor a certified public accounting firm and no portion of the commentary content should be construed as legal or accounting advice. A copy of the Lowe Wealth’s current written disclosure Brochure discussing our advisory services and fees continues to remain available upon request.