Quarterly Economic Update for Lowe Wealth Advisors

By Anirban Basu, Sage Policy Group

Predictions of Growth Fall Short

U.S. and World Economies Remain Soft in 2016

Coming into 2016, many economists believed that the global economy was poised for a mini-resurgence and that the U.S. economy would approach a 3.0 percent rate of growth. These same economists were predicting that the Federal Reserve would increase short-term interest rates three or four times in response to rapidly improving economic conditions.

Wrong on all fronts. The International Monetary Fund has repeatedly downgraded its global growth forecasts, including most recently in October 2016. According to the Fund and as reported by the Wall Street Journal, the failure of policymakers to successfully address deep-rooted problems in the world’s most important economies (e.g., U.S., Europe, Brazil, China, Russia) has thrown the globe into its worst slow-growth rut in roughly three decades. According to IMF Managing Director Christine Lagarde, the “political pendulum threatens to swing against economic openness, and without forceful policy actions, the world could suffer from disappointing growth for a long time.”

The Fund forecasts 3.1 percent global economic growth this year, well below historic norms. The outlook for growth in developed economies like the U.S. and Japan is just 1.6 percent compared to 2.1 percent growth last year. The Fund recently slashed its outlook for 2016 U.S. economic growth from 2.2 percent, which was the standing forecast in July, to just 1.6 percent.

Although many across the globe blame free trade for their emerging challenges, global trade volumes are no longer growing as they once did. The volume of world trade has expanded by around 3.0 percent per year since 2012, half the growth rate experienced over the last 30 years.

Indeed, the International Monetary Fund has been sending out a number of warning signals about the global economy recently. For example, according to the Fund, the world is awash in 152 trillion dollars of debt, an all-time high that sits at more than double the amount of debt owed at the turn of the century. As reported by CNBC, a prolonged stretch of low interest rates that persists in much of the world had led many corporations to take advantage of favorable terms and to issue aggressive levels of debt. The International Monetary Fund is working to pinpoint the biggest sources of risk to the global financial system, noting that not only is private debt elevated among advanced economies, but it is also elevated in several systemically important emerging market economies like China and Brazil. The Fund has singled out the former as a nation at risk of a disorderly wind-down from presently high corporate debt levels.

All of this helps explain the Federal Reserve’s reluctance to raise rates higher. Despite ongoing movement toward full employment and growing evidence of wage inflation, the Federal Reserve refused to raise key interest rates in both June and September of 2016 despite signaling earlier that rate hikes were on their way. The standing presumption is that the Federal Reserve will raise rates in December 2016, an action last taken in December 2015.

Still, the U.S. economy continues to expand. In June 2016, the current economic expansion celebrated its seventh birthday. Many would characterize the recovery from the Great Recession as a 2.0 percent recovery. That’s largely correct. Since the recession ended, the U.S. economy has expanded 2.1 percent on an annualized basis.

But the pace of growth has fallen short of that in recent quarters. According to the Bureau of Economic Analysis, national output as measured by gross domestic product (in 2009 dollars) expanded at a 1.4 percent annual rate during the second quarter of 2016. During the prior quarter (Q1:2016), the U.S. economy expanded just 0.8 percent on an annualized basis and only 0.9 percent the quarter prior before that. The upshot is that national output was only up 1.3 percent on a year-over-year basis based on second quarter data.

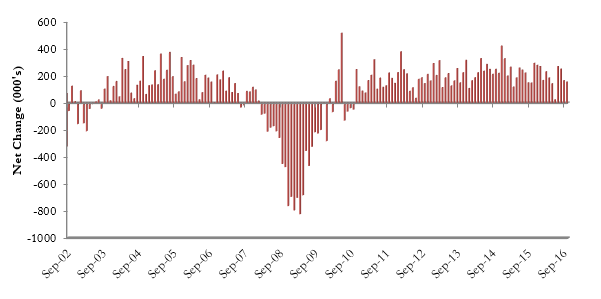

Exhibit 1. National Monthly Job Growth, September 2002–September 2016, SA

Wages are rising more rapidly in many industries despite the fact that the typical American worker has become less productive. According to the Bureau of Labor Statistics, nonfarm business sector labor productivity fell by 0.6 percent on an annualized basis during the second quarter of 2016. Meanwhile, unit labor costs rose by 4.3 percent. Data indicate that the typical American worker is less productive now than they were a year ago.

That’s not good for profitability. Due to a combination of a weak global economy, sagging exports, diminished commodity prices and low productivity, American corporate profits have been shrinking. According to FactSet, the estimated earnings decline for the S&P 500 during the third quarter of 2016 is -2.1 percent. If earnings in fact dip for the third quarter, it will mark the first time that the S&P has recorded six consecutive quarters of year-over-year declines in earnings.

The U.S. Bureau of Labor Statistics reports that America added 156,000 non-farm jobs on net in September. The summer of 2016 will be remembered as a rather good time for job growth. Unemployment still ticked higher in September, to 5.0 percent, primarily because Americans are re-entering the labor force in larger numbers. The U.S. labor force participation rate stands at 62.9 percent.

According to the government’s JOLTS (Job Openings and Labor Turnover Survey), America has never had as many job openings as it does right now. Labor costs are consequently on the rise, and more businesses are complaining about their respective local labor forces.

This suggests that Federal Reserve policymaking must change. For roughly the last two years, the Federal Reserve could focus on one of its two mandates – bringing the U.S. economy to full employment. The fact that energy prices swooned during and after the summer of 2014 soaked much of the inflation out of the economy, allowing the Federal Reserve to essentially ignore its other mandate – hold excess inflation at bay.

That is changing. Commodity prices are no longer falling, healthcare costs are surging and wages are expanding more rapidly. We anticipate three interest rate increases next year, and that could negatively impact certain asset prices that we deem to be high relative to economic fundamentals, including stocks, bonds, commercial real estate and apartment buildings. Those asset price adjustments arguably represent the major threat to the U.S. macro-economy in 2017 and 2018.

The views and opinions of Anirban Basu do not necessarily reflect those of Lowe Wealth Advisors. Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by Lowe Wealth Advisors, LLC), or any non-investment related content, made reference to directly or indirectly in this newsletter will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this newsletter serves as the receipt of, or as a substitute for, personalized investment advice from Lowe Wealth Advisors, LLC. Please remember to contact Lowe Wealth Advisors, LLC, in writing, if there are any changes in your personal/financial situation or investment objectives for the purpose of reviewing/evaluating/revising our previous recommendations and/or services. Lowe Wealth Advisors, LLC is neither a law firm nor a certified public accounting firm and no portion of the newsletter content should be construed as legal or accounting advice. A copy of the Lowe Wealth Advisors, LLC’s current written disclosure statement discussing our advisory services and fees continues to remain available upon request.