Bradley Williams, Chief Investment Officer

June 11, 2018

The National Bureau of Economic Research (NBER) is commonly looked to in determining the beginning and end of economic cycles. The organization has compiled economic data from 1854, delineating the peak, trough, and length of each business cycle in the United States.

The current economic expansion, according to NBER, has now become the second longest on record at 107 months. This cycle has surpassed the previous second longest expansion of the 1960s and now only trails the 120-month expansion experienced through most of the 1990s. Further, a look at current readings suggests this expansion has a chance of becoming the new record holder.

Since the beginning of the data series, the average expansion cycle has lasted just under 39 months and for the 11 most recent expansions since 1945, that average has been 58 months. The duration of this cycle has almost certainly been aided by the monumental level of stimulus provided by central bank policymakers around the world.

Importantly, the tides of these programs are beginning to shift. The U.S. Federal Reserve has already commenced small contractions of its balance sheet and the current expectation is the European Central Bank (ECB) will transition to shrinking its balance sheet by the end of this year.

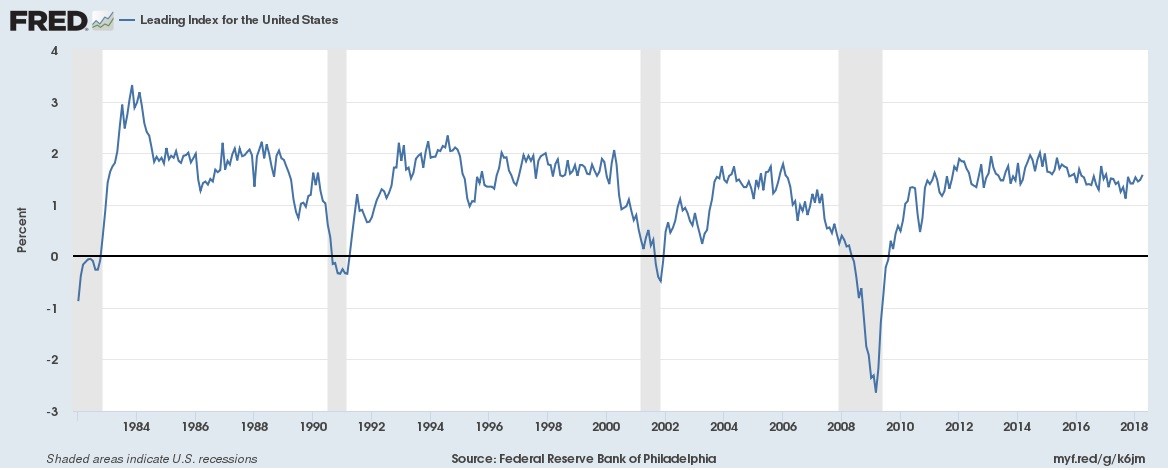

This will likely prove a complex task for policymakers to remove the stimulus while not capsizing business activity. Fortunately for central bankers, this process begins with the wind at their back – leading indicators in the United States reflect greater strength now than in past times leading into recession.

IMPORTANT DISCLOSURE INFORMATION

Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by Lowe Wealth Advisors-“Lowe”), or any non-investment related content, made reference to directly or indirectly in this blog will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this blog serves as the receipt of, or as a substitute for, personalized investment advice from Lowe. Please remember that if you are a Lowe client, it remains your responsibility to advise Lowe, in writing, if there are any changes in your personal/financial situation or investment objectives for the purpose of reviewing/evaluating/revising our previous recommendations and/or services, or if you would like to impose, add, or to modify any reasonable restrictions to our investment advisory services. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his/her individual situation, he/she is encouraged to consult with the professional advisor of his/her choosing. Lowe is neither a law firm nor a certified public accounting firm and no portion of the blog content should be construed as legal or accounting advice. A copy of the Lowe’s current written disclosure Brochure discussing our advisory services and fees is available for review upon request. Please Note: Lowe does not make any representations or warranties as to the accuracy, timeliness, suitability, completeness, or relevance of any information prepared by any unaffiliated third party, whether linked to Lowe’s website or blog or incorporated herein and takes no responsibility for any such content. All such information is provided solely for convenience purposes only and all users thereof should be guided accordingly.