April 15, 2015

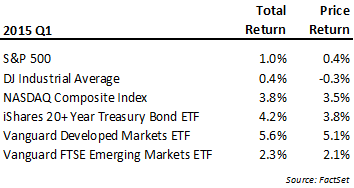

The U.S. equity market (S&P500) delivered a total return of 1.0% in the first quarter, the slowest start for the first three months of a year since 2009. A weak start in January followed by a strong rebound in February saw the U.S. equity markets go lower and then higher from where they ended 2014, but by the end of the quarter, the net gains were modest. In many respects, it was a solid performance for equities given the challenges presented by slowing economic activity and the speculation over a hike in the Fed Funds rates. For fixed income securities, the weakening economic data appeared to supersede expectations of a rate hike as interest rates generally saw further decline in the quarter, causing bond prices to rally.

In many respects, it was a solid performance for equities given the challenges presented by slowing economic activity and the speculation over a hike in the Fed Funds rates. For fixed income securities, the weakening economic data appeared to supersede expectations of a rate hike as interest rates generally saw further decline in the quarter, causing bond prices to rally.

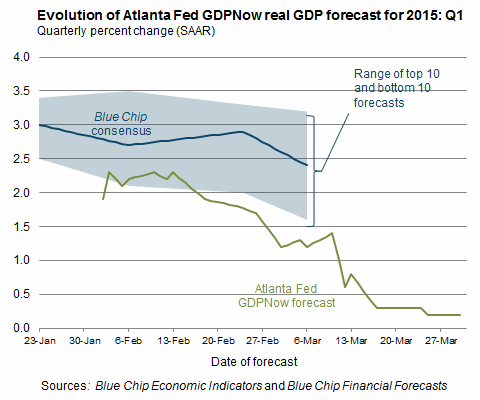

In some ways the start of 2015 looks very similar to the start of 2014 – modest equity gains against a steady fall in the level of economic activity with extenuating weather events again playing a role. Economic activity as measured by Gross Domestic Product (GDP) is reported quarterly, but a model by Atlanta Federal Reserve has quickly gained a following for its effort to capture a “real-time” quantification of GDP growth. This measure, as seen in the accompanying chart, saw steady decline during the first quarter and exited March with a reading at nearly 0%. Severe winter storms in major cities again played a role, but the rapid appreciation of the dollar and reductions in investments by energy companies also contributed to the decline. Still, if first quarter GDP growth does come in at 0% it will be better than last year when the first quarter GDP change came in at -2.1%.

A distinct difference this year from last in the relentless appreciation of the U.S. dollar (see chart of U.S. Dollar Index.) Following on gains that began in August of last year, the U.S. greenback continued its move against other major currencies as investors viewed our economy, recent softening notwithstanding, as relatively healthier. The directional moves in the currencies were further spurred by foreign central banks assuming the comparative lead in levels of monetary stimulation. During the quarter the European Central Bank (ECB) did not disappoint and announced its quantitative easing program in January. That program, which equates to €1 trillion annually in bond purchases, was met by rising equity prices and falling bond yields. In fact the ECB program to print money and purchase bonds has resulted in rates for several European countries across multiple maturities falling into negative territory.

While the stimulative central bank actions are read favorably by equity investors, the moves in rates and currencies do have real ramifications. The substantial move in the dollar has in turn put pressure on the foreign sales and earnings of domestic companies. This headwind, coupled with the weather distractions and pain in the energy sector, resulted in downward revisions to earnings expectations for all 10 industry sectors during the quarter. Earnings estimates for the S&P500 in the first and second quarter of 2015 are now below the comparable figures for 2014 (source: Factset). Last year after the weak first quarter the economy saw a very dramatic bounce back during the middle two quarters. This year a weak energy sector and strong dollar could make that bounce more difficult.

A decline in earnings expectations that becomes something more than transitory could certainly materialize into more of an obstacle for equities given the lengthy tenure of this bull market and extended relative valuation levels. However, the magnitude of any fundamental obstacle ebbs and flows on the perceptions of central bank policy. Like it or not, after years of monetary intervention and literally trillions in stimulus from all the major central banks around the world, the markets hang heavily on potential shifts in policy. As a result, the periods of elevated volatility are now most associated with Fed meetings and the release of data deemed important to their decision making.

We continue to operate under the expectation the markets will experience more volatility stemming from the heavy hand of central policy, but the challenges to significant Fed action here remain daunting. During the quarter we made modest adjustments to the Lowe Wealth Advisors investment strategies. We increased our exposure to international markets in our growth strategy and added an investment in a gold ETF for most clients. The addition of gold takes advantage of the price weakness seen in the commodity over the past three years and the emergence of negative interest rates, which minimizes the “cost of carry” burden normally associated with holding precious metals.

We expect that any substantial shifts in major central bank policy will occur more slowly and gradually than expected and that this remains one the most important focal points for markets. Ongoing declines in fundamental expectations or big changes in monetary policy could, however, could shift that view and cause us to alter our strategy. In the meantime, as challenging as the investment landscape is here, we are pleased to be able to navigate it with sufficient alternatives in securities to those with negative yields such as those emerging in other parts of the world.

Bradley Williams

Chief Investment Officer

Lowe Wealth Advisors

Lowe Wealth Advisors is an SEC registered investment adviser that maintains a principal place of business in the State of Maryland. The Firm may only transact business in those states in which it is notice filed or qualifies for a corresponding exemption from such requirements. For information about the registration status and business operations of Lowe Wealth Advisors, please consult the Firm’s Form ADV disclosure documents, the most recent versions of which are available on the SEC’s Investment Adviser Public Disclosure website at www.adviserinfo.sec.gov.

This commentary is intended for the dissemination of general information regarding market conditions to Lowe Wealth Advisors clients. The information contained herein should not be construed as personalized investment advice. Past performance is no guarantee of future results, and there is no guarantee that the views and opinions expressed in this report will come to pass. While any general market information and statistical data contained herein are based on sources believed to be reliable, we do not represent that it is accurate and should not be relied on as such or be the basis for an investment decision. Any opinions expressed are current only as of the time made and are subject to change without notice.