Joshua Sacks, CFP®, Director of Financial Planning

It is that time of year again. The days are getting shorter. The thermostat has been switched to “heat”. There is a seemingly endless supply of leaves finding their way onto your lawn. To top it all off, the 2019 cost of living adjustment for social security income has been announced.

The Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W) is used as a guideline in the Social Security adjustment process. The CPI-W is recalculated each year to quantify the effect inflation has on our day to day lives. Milk, gasoline, housing, and many other items get more expensive over time. The goal for the cost of living adjustment in Social Security income is to account for those increases over time.

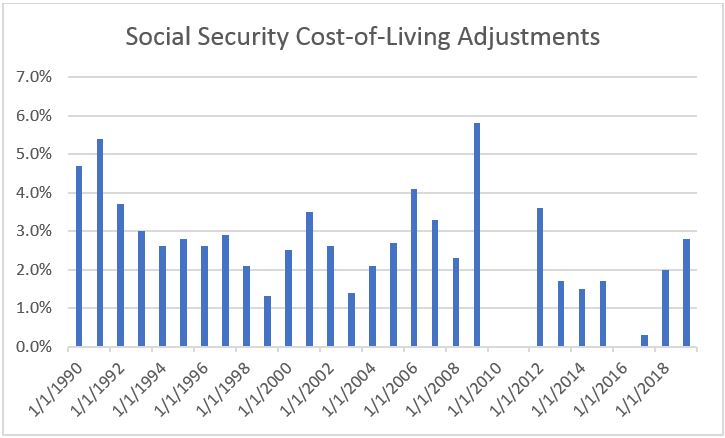

The 2019 adjustment is officially 2.8% and will go into effect January 2019. This adjustment is the second highest increase of the past decade which has included three years with no increase at all. Additionally, the 2.8% increase is more than double the past decade’s average of 1.36%. Seeing an increase as substantial as 2.8% can be encouraging to retirees, but also signals that the CPI-W sees inflation beginning to rise. Below is a graph showing the cost-of-living adjustments since 1990.

An additional change includes the Social Security tax earnings cap increasing.

In 2018, the maximum amount of earnings subject to the 6.2% Social Security tax was $128,400. Next year will see that earnings cap move up $4,500 to $132,900. This has the potential to increase the tax burden on workers as much as $279 for 2019.

Another change that is of high-importance to retirees each year is the subsequent increases in Medicare costs. In fact, the rising cost of Medicare premiums can erode the increase in Social Security benefits. As such, it is important to determine what the increase in Medicare premium cost may be. There are numerous variables which impact individual premium increases. If you click the link below, you can read the release from The Centers for Medicare & Medicaid Services which reviews the variables.

Link: https://www.cms.gov/newsroom/fact-sheets/2019-medicare-parts-b-premiums-and-deductibles

If you would like to better understand the impact that inflation may have on your personal situation or financial plan, please reach out to us here at Lowe Wealth Advisors.

Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by Lowe Wealth Advisors, LLC (“Lowe”), or any non-investment related content, made reference to directly or indirectly in this newsletter will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this newsletter serves as the receipt of, or as a substitute for, personalized investment advice from Lowe. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his/her individual situation, he/she is encouraged to consult with the professional advisor of his/her choosing. Lowe is neither a law firm nor a certified public accounting firm and no portion of the newsletter content should be construed as legal or accounting advice. A copy of the Lowe’s current written disclosure Brochure discussing our advisory services and fees is available upon request. If you are a Lowe client, please remember to contact Lowe, in writing, if there are any changes in your personal/financial situation or investment objectives for the purpose of reviewing/evaluating/revising our previous recommendations and/or services, or if you would like to impose, add, or to modify any reasonable restrictions to our investment advisory services.