Conflicting Economic Numbers Paint a Confused Portrait Heading into 2019

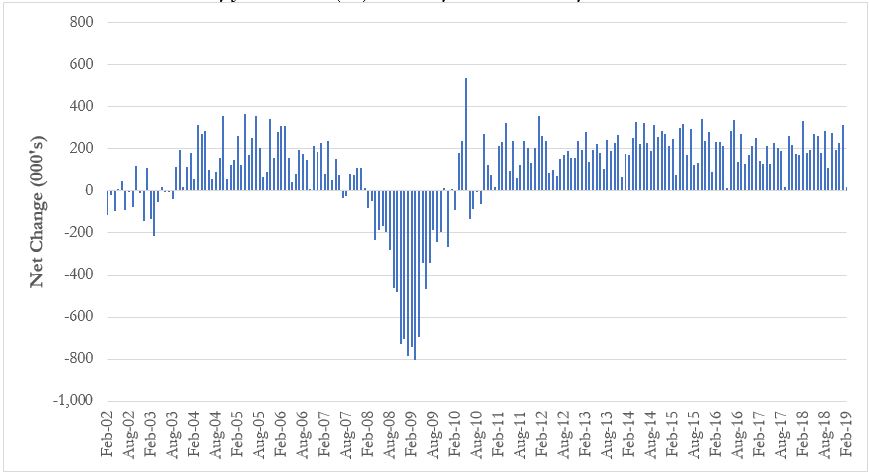

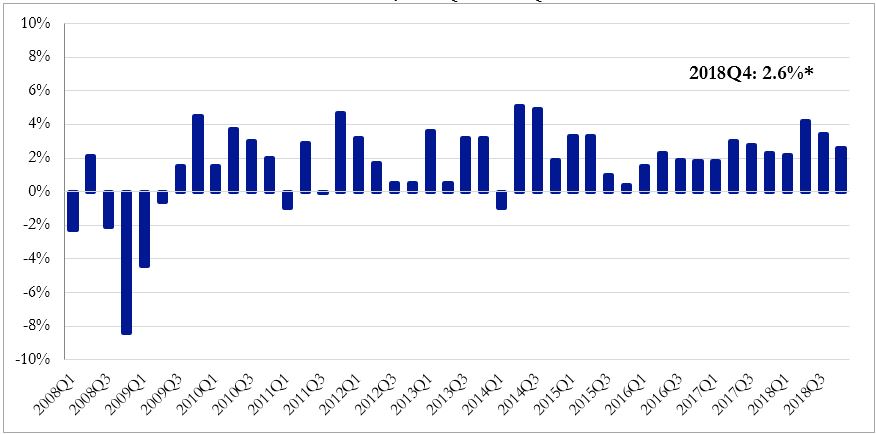

The year 2018 will go down as a fine year for the U.S. economy. Despite evidence of a slowing global economy, America’s still managed to expand 2.9 percent last year. The U.S. ended the year in fine fashion, with the nation adding 227,000 net new jobs in December 2018. That month was associated with 1.8 percent more jobs than were registered the same month one year earlier.

Even as the U.S. entered its 10th year of economic recovery last year and saw unemployment dip toward a 50-year low, economy-wide inflation remained benign. According to the core Consumer Price Index, inflation during a recent 12-month period stood at 2.1 percent. The core PCE (personal consumption expenditures) deflator indicates 1.9 percent inflation, below the Federal Reserve’s stated targeted.

The result has been a Goldilocks scenario with the U.S. economy expanding fast enough to allow corporations to produce growing earnings, but not so fast to trigger problematic inflation. After raising rates 9 times since December 2015, the Federal Reserve appears to have paused, further bolstering equity markets. Accordingly, Goldilocks is up to her old tricks, consuming porridge at just the right temperature, sleeping in comfortable beds, and scooping up U.S. equities. By mid-March, the Dow Jones was trading right around 26,000 while the S&P sped past 2,800. Bears remained comfortably out of sight.

Nonetheless, a sense of unease appears to have settled across the land. There are a number of reasons for this, including issues at Boeing and Apple. But at the heart of the increasingly pervasive feeling that not all is right is a slew of recent data releases indicating vulnerability.

It began in December 2018 itself. Retail sales fell 1.6 percent that month according to revised data, suggesting that consumers had begun to pull back. There are a number of potential explanations, including growing indebtedness, weather, or unease regarding a then-anticipated federal government shutdown.

Most economists considered the weak retail sales numbers a fluke. After all, with the nation adding jobs briskly, unemployment at or below 4 percent, and wages growing at their most rapid level in about a decade, there is little reason to expect a protracted consumer pullback anytime soon.

But then more troubling data arrived. Data from the federal government indicated that the national debt and the annual federal budget deficit have been expanding rapidly. The federal deficit for FY2018 totaled $779 billion, an increase of $122 billion from the previous year. This represented the highest tally since 2012 when the economy was still trying to fully recover from the 2008-09 financial crisis. During the initial four months of the current federal fiscal year, the budget deficit totaled $310.3 billion, up an astonishing 77 percent from the same period one year earlier.

Other data came out regarding America’s trade deficit with the balance of the world. Though America generated a surplus in trade in services last year, the trade deficit in goods has never been higher. In 2018, the U.S. generated an $891.3 billion deficit in goods. The overall trade deficit expanded by nearly 13 percent last year, which all things being equal subtracts from economic growth.

As if this were not enough, the jobs report for February 2019 indicated that the nation added only 20,000 net new jobs that month. While many economists attributed the number to poor data collection and/or weather, the release represented the latest in a string of data that are collectively becoming more difficult to ignore. On top of this have been even more recent data indicating a slowdown in industrial production as well as diminished consumer and small business confidence.

All along, economists have been racing to downgrade their forecasts for economic growth in 2019. A recent Wall Street Journal survey of economists indicates that about 84 percent expect the next 12 months to be associated with softer economic growth than the prior 12 months.

Looking Ahead

Many economists continue to forecast an economic downturn in 2020 or 2021, but few can point to a likely triggering event. While economists like to say things like “economic recoveries don’t die of old age”, many economists seem to believe that the time for the next downturn has come.

There are many risks, including a trade war with China, sharp declines in asset prices, and a sudden spike in interest rates should inflation data become less benign. However, there are also outcomes that could serve to further strengthen economic performance and extend the current expansion. Among these is a trade deal with China, the cessation of tariffs on steel, aluminum, and softwood lumber (which would be deflationary or disinflationary and would help keep interest rates low), a federal infrastructure package, and further indications that the Federal Reserve is in fact on the sidelines for now.

Perhaps the more likely outcome is that rising inflationary pressures will eventually become apparent (it hasn’t happened yet). That will drive borrowing costs higher and certain asset prices lower, which will trigger the next economic downturn. Already, there is evidence of softening global economic growth, weakening U.S. industrial production, slackening small business investment, softer home price appreciation, and increasingly sluggish auto sales. Many economists expect this nascent economic weakness to broaden as 2019 proceeds, but one must remain open to the possibility that these expectations are misguided and that the current economic expansion could persist into and beyond 2021 given the right set of policy outcomes.

Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by Lowe Wealth Advisors, LLC), or any non-investment related content, made reference to directly or indirectly in this newsletter will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this newsletter serves as the receipt of, or as a substitute for, personalized investment advice from Lowe Wealth Advisors, LLC. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his/her individual situation, he/she is encouraged to consult with the professional advisor of his/her choosing. Lowe Wealth Advisors, LLC is neither a law firm nor a certified public accounting firm and no portion of the newsletter content should be construed as legal or accounting advice. A copy of the Lowe Wealth Advisors, LLC’s current written disclosure statement discussing our advisory services and fees is available upon request. If you are a Lowe Wealth Advisors, LLC client, please remember to contact Lowe Wealth Advisors, LLC, in writing, if there are any changes in your personal/financial situation or investment objectives for the purpose of reviewing/evaluating/revising our previous recommendations and/or services.