Remarkable Year

January 19, 2018

It’s probably safe to say no one foresaw how the past year would play out for financial markets, particularly given the backdrop of various news events. Equities had a very strong year virtually everywhere, achieving a multitude of milestones for index prices and minimal volatility.

|

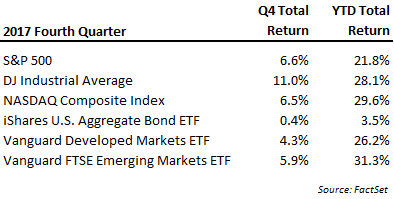

Over the year the S&P500 returned 21.8%, the Dow Jones Industrial Average returned 28.1% and the technology-focused NASDAQ index saw a total return of 29.6%. Returns for each were positive in the fourth quarter and marked the eighth quarter in a row of gains for the S&P 500. In the fourth quarter international markets lagged domestic markets somewhat, but still had solid gains. The gains in the fourth quarter culminated in a year in which most equity indices around the world finished with returns measured solidly in double-digits.

The bond market, by contrast, saw little net change over the quarter despite the Fed issuing its third interest rate hike for the year and outlining a plan to reduce securities holdings on its balance sheet – more on that later. For the year, rates generally declined early and rose in the second half as the rate plans from central banks shifted. The net change in rates for the 10-year U.S. Treasury over the full year was an increase of less than five basis points, but exited the year on a rising trajectory. For 2018 the Fed indicated it plans on an additional three interest rate increases, assuming the economic backdrop remains strong. Thus far, the move upward in rates has been more pronounced for shorter-term maturities rather than longer-term debt. The most substantial of the moves across the yield curve has been in the two-year Treasury, which now yields more than the dividend rate of the S&P500 – the first time in more than 10 years.

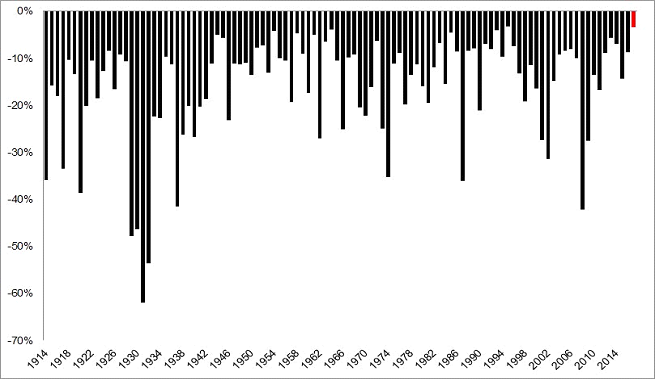

In our summary from the third quarter of 2017, we noted several metrics illustrating how volatility, sentiment, and valuation were near or had reached record levels. These characteristics did not change in the fourth quarter, but in most cases became even more pronounced. Looking further at volatility, or the lack thereof, the U.S. stock market finished the year with its smallest annual high-to-low drawdown ever (see chart) and the S&P500 never saw a down month (14-month streak, actually). Price and valuation metrics also advanced as the stock market saw various indices record repeated record levels.

Synchronized global economic growth and still-supportive global monetary policy continue to be the backdrop for rising stock prices. The healthy economic environment allowed for an acceleration in corporate earnings growth in 2017 compared to 2016 and provides the basis for a positive 2018 outlook. The forecast for increased corporate earnings in 2018 is further reinforced by the recent passage of the U.S. Tax Cuts and Jobs Act of 2017. These trends are reflected in positive readings for various leading indicators such as confidence, business orders, and employment, all of which show virtually no signs of pending economic deterioration.

That said, the length of this economic up-cycle is nearing one of the longest on record and asset prices have reflected so much good news that valuation levels are not only high relative to historic ranges, but in many cases rival past extreme peaks (1929, 1999). This year, however, stocks and bonds may be challenged to deal with underlying trend changes in two factors that have thus far been highly beneficial to their advance – falling interest rates and central bank stimulus flows. Either of these could represent a new headwind to the ongoing advancement of stocks and both deserve to be watched closely as we move through 2018.

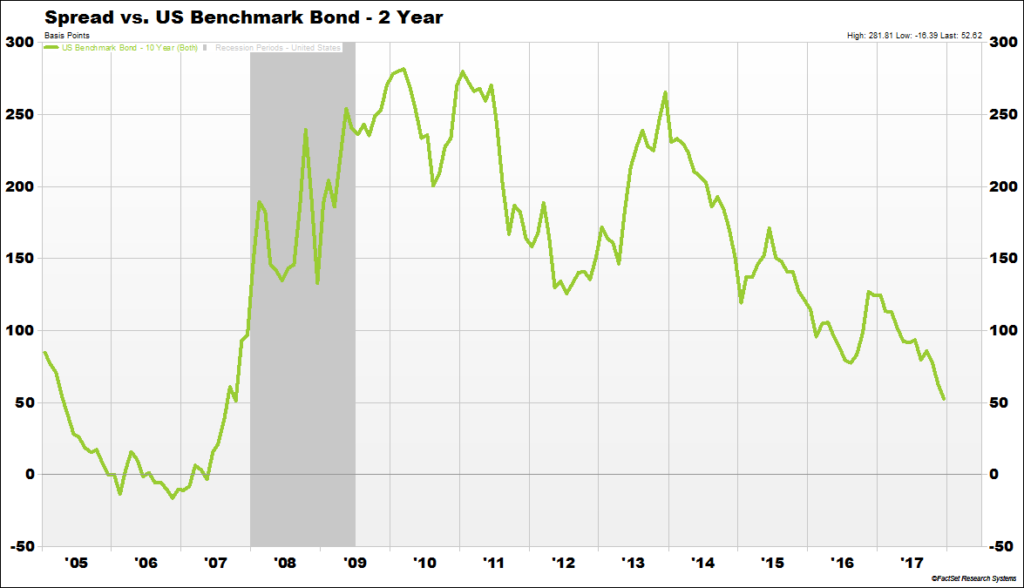

The yield on the 10-year Treasury, one of the more commonly cited metrics for interest rates, finished 2017 yielding almost exactly where it started 2017. The trend, however, was rising and that has continued into January. Importantly, yields on shorter-term instruments have been rising even faster. The difference between the two rates, or the spread, is watched closely for indications of economic strength. A large positive difference between the 10-year rate and the 2-year rate suggest a healthy, growing economy. By contrast, a tight spread or negative difference implies a more negative outlook held by the bond market. Investors pay attention to this difference as a tight or negative spread has been a very good predictor of recessions in the past. This is a challenge for policymakers as hiking short-term rates too quickly relative to economic growth can choke off growth. Currently, the yield curve remains positively sloped, but it did flatten notably in 2017 and further declines in the difference between short- and long-term rates could become more challenging for the market. The chart below shows the recent trend and one can also see how this measure fell and became negative in advance of the last recession (shaded area).

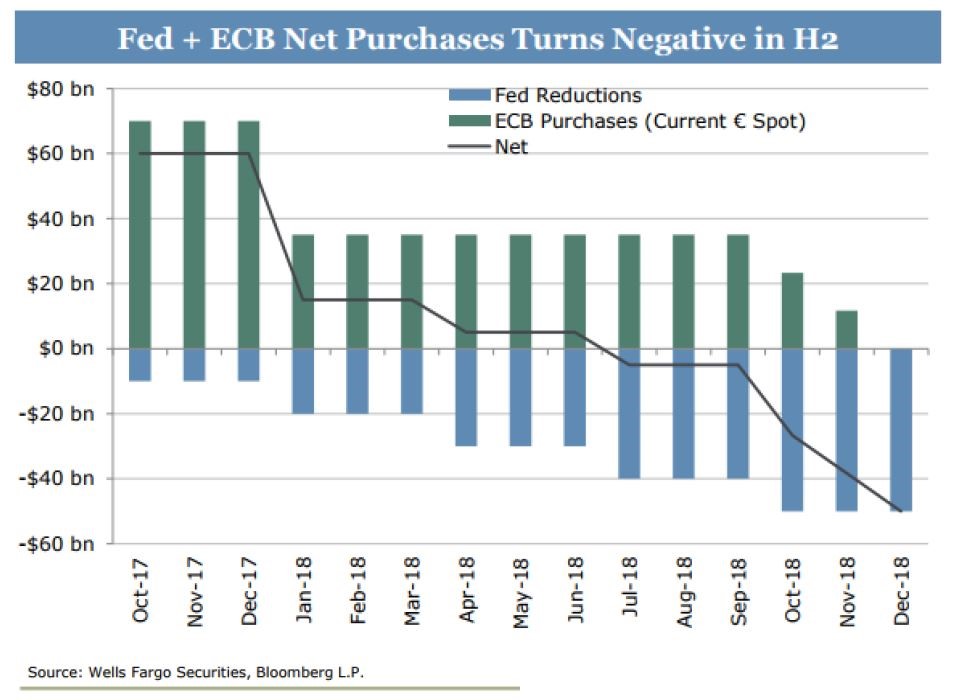

Another source of change for financial markets in 2018 may come from a reduction to the flow of central bank stimulus. We have noted many times in the past the enormous amount (literally trillions) of money central bankers have injected into markets since 2009. Despite the fact economies around the world are far from the economic precipice faced in 2008, the central banks have steadily pumped more and more money into financial markets buying bonds, buying stocks and suppressing interest rates. That trend of buying more, however, may be set to shift in 2018. With the U.S. Fed having announced a plan to begin reducing its asset holdings and the European Central Bank outlining a plan to reduce their purchases, the net flow of new capital from central banks is expected to move from positive to negative by mid-2018. The sums involved will be relatively small to start, but it will be important to see how markets are affected by the incremental loss of a largely price indiscriminate buyer. Among foreseeable factors, we believe this change and the related trends in interest rates may be the most influential dynamics for financial markets in 2018.

The overhaul of the U.S. tax system was a source of news and speculation for most of 2017. The “Tax Cuts and Jobs Act” was passed at the end of 2017, but the details strayed a fair bit from the campaign trail. From what can be determined now, large businesses will see reductions in tax rates. The impact on individuals will be more nuanced as there will be gains and losses based on a set of rate adjustments offset by significant changes in deduction schedules. We believe the impact will be more noticeable in corporate profits (and therefore S&P earnings) than in pocketbooks of most citizens, although the exact details will take some time to become clear. The tailwind may prove to be a shorter duration boost for the stock market than a long-term uplift to economic growth, particularly if the corporate gains are used more for stock buybacks and dividends rather than capital investment – time will tell. Regardless, one headwind eventually coming from the tax plan will be an increase in deficits, further adding to the total outstanding debt of the country.

“Be Fearful When Others Are Greedy and Greedy When Others Are Fearful” – Warren Buffett

In our view, synchronized global growth, rising corporate earnings, and positive sentiment need to be balanced against realities of a very long expansion cycle and valuations that are unambiguously lofty. Volatility and risk measures suggest an extremely high degree of investor confidence while aggressive speculation in sectors such a cryptocurrencies point to an almost complete lack of fear. Central bank stimulus that began as a tool to forestall financial gridlock almost a decade ago has seemingly morphed into the objective of eliminating the business cycle. The intervening calm has pushed many assets to extremes which may intensify risks in the downside of a cycle.

Our objective in managing capital remains to look for growth opportunities while maintaining a strong desire for capital preservation should market risks become topical again. Adjustments we may consider include increasing diversification with assets that have better relative value metrics and maintaining positions in portfolios that could counter-balance stock weakness. As we noted, the financial markets may face a couple trend changes in factors that have been a key part of the year’s asset price advancement. This will again mark new territory and it is unknowable in advance exactly how things will unfold, but we believe the conditions reinforce the importance of disciplined risk management. As these developments unfold we will continue to communicate any changes in our view and corresponding implications for client allocations.

Bradley Williams, Chief Investment Officer

Lowe Wealth Advisors

Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by Lowe Wealth Advisors, LLC), or any non-investment related content, made reference to directly or indirectly in this newsletter will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this newsletter serves as the receipt of, or as a substitute for, personalized investment advice from Lowe Wealth Advisors, LLC. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his/her individual situation, he/she is encouraged to consult with the professional advisor of his/her choosing. Lowe Wealth Advisors, LLC is neither a law firm nor a certified public accounting firm and no portion of the newsletter content should be construed as legal or accounting advice. A copy of the Lowe Wealth Advisors, LLC’s current written disclosure statement discussing our advisory services and fees is available upon request. If you are a Lowe Wealth Advisors, LLC client, please remember to contact Lowe Wealth Advisors, LLC, in writing, if there are any changes in your personal/financial situation or investment objectives for the purpose of reviewing/evaluating/revising our previous recommendations and/or services.